A former professional hockey player is betting that the mundane business of collecting trash will be a draw for investors unnerved by recent flops in the market for new public companies.

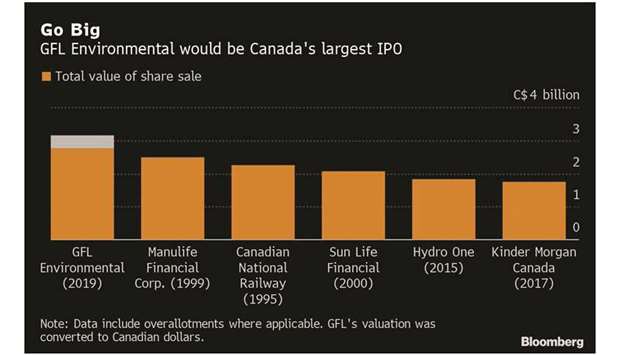

GFL Environmental and chief executive officer Patrick Dovigi aim to raise as much as $2.1bn in what would be Canada’s largest ever initial public offering.

The IPO, which could run to $2.4bn if additional shares are sold, would surpass Manulife Financial Corp’s $1.7bn offering two decades ago.

Dovigi, 40, turned GFL – Green For Life – into North America’s fourth-largest waste hauler with a string of debt-backed acquisitions. But he’s coming to market at a volatile time for new listings. Co-working company WeWork’s planned IPO imploded over concerns about governance and profitability.

Shares of indoor-cycling firm Peloton Interactive have slumped since its trading debut. Newly-listed Canadian cannabis stocks were soaring last year but have tumbled as profit expectations fade.

GFL’s predictable business of trash collection may have more luck with investors.

With more than 10,000 employees and operations across Canada and 23 US states, the company collects and disposes of solid, liquid and hazardous waste, including organics and recyclables using a fleet of bright green trucks. It also offers infrastructure services such as soil remediation.

“We would definitely be interested in looking at it and meeting with management and potentially putting it into our portfolio,” Mike Archibald, associate portfolio manager at AGF Investments, said. “The most important point is that they are a fully-integrated waste management company.

They have a lot of things that will allow for margins to continue to move higher over time.”

The sale of 87.6mn shares for between $20 and $24 apiece would value the Vaughan, Ontario-based company at about $7.5bn at the top end of the range. The IPO is being led by JPMorgan Chase & Co, Bank of Montreal, Goldman Sachs Group, Royal Bank of Canada and Bank of Nova Scotia. It’s expected to start trading on the New York and Toronto Stock Exchanges in the next couple of weeks.

Dovigi, a cousin of Hockey Hall of Famers Phil and Tony Esposito, was drafted by the Edmonton Oilers and played two games as a goalie in the East Coast Hockey League. He founded GFL in 2007 and has made over 100 acquisitions since, the largest being the $2.8bn purchase of Waste Management Industries USA in 2018.

That helped propel its revenue to C$2.7bn ($2.06bn) in fiscal 2018 from C$934mn in 2016, according to a company filing. GFL forecasts earnings before interest, tax, depreciation and amortisation at C$611mn to C$619mn for the nine months ended Sept. 30.

It has yet to turn a profit and has racked up a lot of debt to fuel acquisitions - C$6.5bn, according to data compiled by Bloomberg. That makes Barry Schwartz, chief investment officer at Baskin Wealth Management, wary.

“They’ve gorged on debt and if they don’t go public this is kind of like a WeWork situation in the sense that the debt is going to engulf them,” said Schwartz, who won’t be buying into the IPO. “So they definitely need to go public and shareholders need to be very discerning. The company really needs to explain how they’re going to pay down that debt.”

GFL said in a company statement it plans to pay down about $800mn of debt with the proceeds from the IPO and use the rest for general corporate purposes including for future acquisitions.

Dovigi is expected to pocket about $22.8mn from the sale of his shares. Along with related entities, he will hold about 3.8% of outstanding stock and about 28.3% of the voting power.

His investors, BC Partners Holdings Ltd will have about 38% of the company and Ontario Teachers’ Pension Plan will hold 14% and GIC, the private-equity investment arm of the Singapore government will own about 9%.

“If you’ve looked at the historical returns and results from Waste Management, Waste Connections or Republic Services, garbage has been gold. It’s been an absolute grand slam,” he said. “I hope they pull it off, they’re just not going to be selling any shares to us and our clients.”

Shares of Waste Management, the largest US trash hauler, have jumped almost 27% this year with a threefold rally since the end of 2011. Republic Services Inc has climbed over 220% in the same period.

“Most publicly traded solid waste companies are expanding at a 3%-5% organic pace, led by price,” said Bloomberg Intelligence analyst Scott Levine in a report. “Tuck-in acquisitions could augment growth, though a high debt burden may limit GFL’s capacity for large deals.

Archibald at AGF said that while GFL does have more leverage than some of its industry peers, it’s not uncommon for this type of business.

“GFL is a significant player and has good assets,” he said. “They have both organic growth and M&A growth. I think it ticks a lot of boxes for a number of investors and they have a well-diversified business.”

.