More of China’s film and TV studios are looking to Hong Kong investors to raise money on renewed confidence in a cinema market that’s back on track to overtake the US as the world’s largest.

Cathay Media Group, known for hit costume dramas and an arts university, filed for an initial public offering in Hong Kong last month, in what could be the third major sale this year for a mainland film and television company.

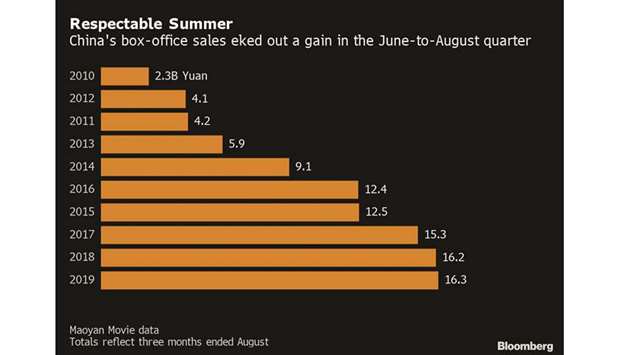

The deals are a sign China’s film industry is recovering after celebrity tax-evasion scandals prompted a government crackdown on financing and as tighter censorship contributed to a box-office sales slump in the first half. Movie ticket sales rose 2% in September following a 13% surge in August – though the industry is still on track for its first annual decline since at least 2011 thanks to big drops in box-office revenue earlier this year.

“If Cathay Media proves to be a success, it will drive more similar companies to come to Hong Kong for listing,” said Wilson Chow, industry leader at PwC China’s technology, media and telecommunications.

A rise in Hong Kong deals would also mark a turnaround after US filmmaker and distributor STX Entertainment, backed by Chinese internet giant Tencent Holdings Ltd, shelved its IPO plan in Hong Kong in October last year, citing “significantly deteriorated” market and political conditions in the region. Maoyan Entertainment, a film distributor and China’s largest online ticketing platform, raised $250mn in its Hong Kong debut in February this year, backed by investors including Tencent.

Mainland television drama studio Shanghai Youhug Media Co, is planning an IPO in the city of at least $100mn, people familiar with the matter said in January. Cathay Media aims to raise about $200mn in its Hong Kong IPO, IFR magazine reported last month, citing people close to the deal. Cathay Media declined to comment.

In its IPO prospectus, Cathay Media points out that competition among streaming services is driving demand for films and television shows. Platforms like Baidu Inc’s iQiyi, Tencent Video and Alibaba Group Holding Ltd’s Youku Tudou are plowing billions of yuan into new programming to attract and retain users.

“There is definitely momentum here,” said Peter Chan, TMT assurance leader at Ernst & Young in Hong Kong. “Hong Kong’s international capital market is definitely attractive to mainland entertainment companies.”

China’s listed film and television studios slumped last year after celebrities including film star Fan Bingbing were accused of evading taxes. Fan fell from public view, only to re-emerge after an apology published on social media and under an agreement to pay more than $100mn in tax and penalties. The scandal, and new government limits on pay for performers, spooked investors and slowed production at studios that had been spooling out films to meet demand that more than quintupled since 2010 to 56.6bn yuan ($8bn) last year.

Among the more than 1,000 mainland-based companies listing in Hong Kong, only four are from the film and television industry. The rise of blockbuster films like Ne Zha, which this year became China’s second-highest grossing movie on record, and Wandering Earth, the third-biggest, is boosting confidence and interest in share sales.

.