Lots of investors chafe at the idea of buying negative-yield bonds. Few are as repelled by the prospect as William Eigen.

The JPMorgan Asset Management fund manager says he’d retire before buying sub-zero securities, even as some of his peers profit from the trade amid mounting fears of a global recession.

He predicts negative-yielding bonds will eventually lead to “devastating” losses and has parked almost half of his fund in cash that will be insulated from a market sell-off.

“The whole concept of negative yields, of people paying for the privilege of lending money, is insane behaviour to me,” Eigen, a 29-year industry veteran who oversees the $12.4bn JPMorgan Strategic Income Opportunities Fund, said in an interview from Boston. “I do not pay to lend money. That’s not fixed-income investing, that’s fixed-loss investing.”

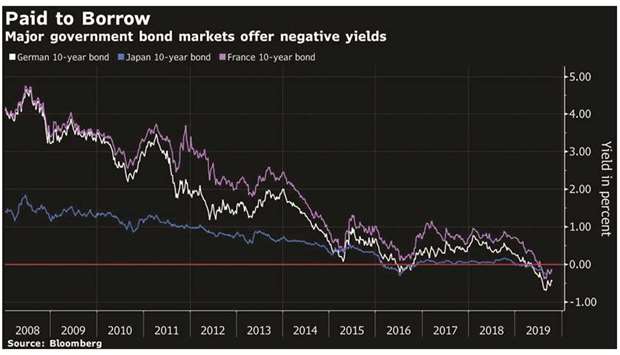

Eigen says investors will ultimately face a train wreck in a market distorted by vast amounts of negative-yielding debt spurred by years of ultra-loose monetary policy from Europe to Japan. Some $13.3tn of securities now trade with sub-zero yields as several European central banks and Japan slashed rates to below zero after the financial crisis in a bid to spur growth.

The measures, including the European Central Bank’s enormous bond-buying programme, were meant to be temporary, but Europe’s benchmark rate has persistently stayed below zero since 2014. The value of negative-yielding bonds has surged 60% this year, triggered in part by fears of a prolonged US-China trade war.

Eigen said he’s shunning the debt even as he predicts a recession in Europe and a “pretty rough” slowdown in the US, which would normally be a good time to buy bonds.

He gave three reasons: Bonds are already pricing in bad times. And you can only make a capital gain from negative-yielding debt “if someone crazier than you is willing to come in to pay more for the privilege of lending money to an over-levered government or a company.”

But most importantly, nothing about the current bond market is sustainable, according to Eigen. Sooner or later, it’s going to crash, and he wants to be there with dry powder when it happens.

“What I’m saying is that you print this much money, you put trillions of dollars of securities on your balance sheet, at some point something’s going to break,” Eigen said. “I’m not saying it’s going to be in the short term, but man, when this thing breaks, the losses fixed-income investors will be facing will be devastating, and it’s my job in that environment to post positive returns.”

Eigen’s fund, which aims to outperform cash, has returned 3.2% in 2019, above the effective Federal Funds rate of 1.75% to 2%. But he’s also trailing behind peers who buy low or negative-yielding bonds: the Bloomberg Barclays Global-Aggregate Total Return Index has gained 6.3% this year.

He’s not alone as bond bears have underperformed this year, with even heavy hitters such as Dan Ivascyn’s Pimco Income Fund and Ray Dalio’s flagship investment losing out amid a global rally.

It’s not just sub-zero rates in Europe that are raising Eigen’s wariness. An automotive enthusiast with a penchant for fast Italian motorcycles, he takes his cues on the economy from customers at two commercial garages that he partly owns in central Massachusetts. Eigen’s not liking what he’s hearing as the 2020 presidential election draws near.

“I see some of our bigger buyers and the bigger customers getting really nervous,” he said. Elections “have become so polarised here in the US that that can’t be good for confidence, and confidence drives the economy.” The cocktail of risks is prompting Eigen to favor cash and highly liquid assets.

His strategy, which can invest in or bet against almost anything in the fixed-income universe, has 21% parked in investment-grade corporate debt. He also favours non-agency mortgages.

Junk bonds now make up less than 5% of the fund from as high as 70% three years ago. While Eigen profited last year from shorting five-year German government debt, he’s not willing to repeat the wager today.

“My feeling is that rates can probably get a bit lower here in the US and German rates will probably follow,” he said.

Even predictions of a further rally in US Treasuries aren’t enough to whet his appetite. He sees potential for the 10-year Treasury yield to drop to 1%.

Eigen’s portfolio is “about as defensively positioned as it’s ever been” and he’s building a war-chest of cash to deploy when bond markets sell off. And in the meantime, even if he loses out on some returns, he won’t be buying securities with negative yields.

“I won’t engage in that,” he said. “The day I buy a negative-yielding security is when I’m retired. I don’t do that for investors. If people want to lock in losses they can do it all by themselves.”

.