US-China trade war is a significant headwind for global GDP growth: QNB

The US-China is just an act in the story of global competition for economic influence. The big picture is of shifting tides in geo-strategic politics from cold war (1950-90), to US dominance (1990-2010), to multipolar world (from 2010), said QNB in its latest report, which reviews the impact of the trade war on the US, China, Europe, and the rest of the world before drawing conclusions.

The US economy has, so far, been relatively insulated from the negative effects of the trade war by the tailwind of Trump’s tax cuts. However, the stimulus from the tax cuts has faded, while the Federal Reserve’s interest rate hikes during 2018 and the escalating trade war since late 2018 are beginning to drag on the economy.

“Going forward the drag on US GDP growth will increase: the longer tariffs are in place; the higher their level; and the more they target consumer good directly. However, with Presidential elections next year and all likely candidates supporting acting tough with China over its trade practices, we are most likely stuck with the current tariffs or further escalation for the foreseeable future. Indeed, the trade war has already forced the Fed to start cutting interest rates, and despite its resistance, will force the Fed to lower interest rates further in late 2019 and into 2020,” QNB said.

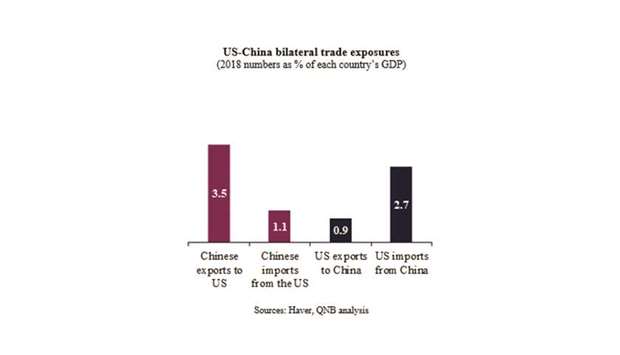

The direct impact of the trade war on China is greater than on the US. China has followed an export-led growth model, which led to particularly strong growth in the five years before the 2009 global financial crisis (GFC). During this period, China specialised in becoming the factory of the world, diverting its large labour force from rural to urban areas and from agriculture into manufacturing.

China responded to the GFC with a massive credit stimulus, directing the banking system to finance investment and infrastructure. This large stimulus via bank lending resulted in a substantial accumulation of debt. Subsequently, the Chinese authorities have allowed GDP growth to slow and sought to encourage a rebalancing of the economy towards domestic consumption via more target stimulus measures. China is now attempting to support continued GDP growth, whilst facilitating rebalancing, QNB said.

The trade war is a challenge because it attacks China’s export-led growth model, but is also an opportunity as it encourages rebalancing. Indeed, China is pursuing two clear strategies to support continued economic growth. First, China is using its Belt and Road initiative to lower transport time and costs and therefore improve its access to markets across Eurasia. Second, China is moving up the value-chain from low-cost manufacturing to more advanced and high valued-added sectors, QNB said.

Mature economies across Europe are struggling with both demographics (particularly aging populations) and domestic politics (such as nationalist influences that are fuelling issues like Brexit). These internal struggles have depressed both GDP growth and inflation. For example, eurozone annual GDP growth has averaged only 1.4% and CPI inflation only 1.4% since 2010.

This forced the European Central Bank to announce a further package of monetary stimulus and beg for some kind of fiscal stimulus. At the same time, the trade war has materially impacted the engine at the core of the eurozone: Germany’s high valued-added and export-orientated manufacturing sector.

As a result, European politicians are working hard to divert US President Donald Trump’s attention away from European agricultural subsidies, Europe’s own import tariffs and the high value of automotive exports sent from Europe to the US, QNB said.

The UK is a special case. After leaving the EU, the UK alone would be a much smaller economy than the US, resulting in a fundamentally weak negotiating position. However, the UK’s long-standing special relationship with the US and Prime Minister Boris Johnson’s rapport with Trump is likely to help the UK get a better deal than it would otherwise be offered.

Canada, Japan, and Mexico are all in broadly the same position in terms of the trade war. All three have a large exposure to the US in terms of exports of advanced manufacturing, particularly automotive, and are all also struggling with weak GDP growth at home.

So, like Europe, they are actively seeking to keep their trade relationship with the US out of the headlines. Also like Europe, their manufacturing industries face the headwind of weaker demand from China. However, these countries are perhaps better placed than most to benefit from US demand for goods that has been displaced from China, QNB said.

The global economy is already adjusting to the persistence of the trade war between the US and China. The main effect is displacement of trade. For example, Vietnam is seeing exports to the US increase by more than imports from China. This is primarily due to US tariffs on China boosting the relative competitiveness of Vietnamese manufacturers, but there is likely to also be some simple re-routing of Chinese exports via Vietnam.

Both the US and China would like a face-saving deal of some kind and this is an upside risk. However, these countries are long-term strategic rivals, so any deal will be neither substantial nor comprehensive. “Hence, we consider further escalation to be more likely than a cease-fire or de-escalation.”

“The intense focus on trade competition in the media and policy making has inevitably increased completion between countries in what can easily become a zero-sum game. Indeed, if the US-China trade war escalates further, it may force China to allow a significant currency devaluation.

“That in-turn may prompt competitors to devalue their own currencies, which could then spiral into a full-blown currency war. The end result is a significant headwind to global GDP growth, which we see being weaker in 2019, 2020, and 2021 than the IMF currently anticipates,” QNB said.