China’s economy continued on a slower trajectory in September, with weakness in manufacturing and retailing combining with the trade war to undercut growth.

Bloomberg Economics’ gauge aggregating the earliest available indicators from financial markets and businesses showed the economy cooling for a fifth month, with indicators for trade, factory prices, and small business confidence all worsening. Rising stock and iron prices boosted those sub-indexes.

Although trade tensions have eased somewhat since last month, there’s been no turn-around in global demand in September, meaning the lean times for exporters and manufacturers continue. Growth in retail sales and investment is slowing too, leaving no clear domestic driver to pick up the slack.

The first official data for September will be released on Monday, when the purchasing manager indexes are announced. Economists currently expect the manufacturing gauge will remain mired in contraction territory, albeit with a slight improvement.

Global trade and investment has been weaker in the third quarter, and “with the combination of slowing global demand and subdued domestic demand, the downward pressure on China’s economy has been increasing significantly,” according to research note from the Bank of China’s Research Institute released on Wednesday.

There’s a rising risk the quarterly growth rate will drop below 6%, according to the report, although the economy may stabilise in the fourth quarter to some extent due to the support from policy and the resumption of China-US trade talks, according to Bank of China.

“The early indicators show more downward pressure on China’s economy in September,” according to Qian Wan, economist at Bloomberg Economics. The Asian bellwether of South Korean exports is flashing red, business surveys point to “broad-based weakness” for companies, especially smaller ones, and deflation is deepening, which will further stress industrial companies’ profits, she said.

Small business confidence declined in September after stabilising last month, according to a survey by Standard Chartered Bank, which said the real-estate and property sectors were dragging down the overall result. Firms were more pessimistic in that survey, with the outlook declining.

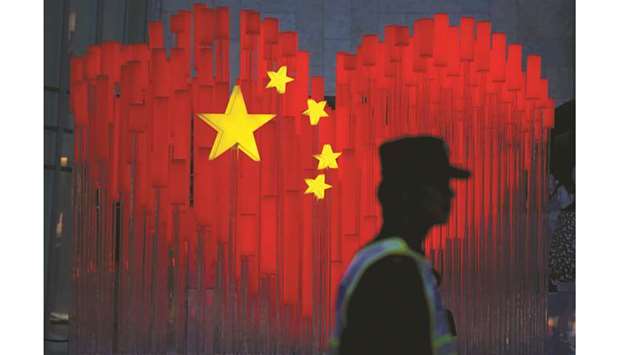

A heart-shaped Chinese flag installation ahead of the 70th founding anniversary of People’s Republic of China is seen on a street in Shanghai yesterday. Bloomberg Economics’ gauge aggregating the earliest available indicators from financial markets and businesses showed the economy cooling for a fifth month, with indicators for trade, factory prices, and small business confidence all worsening.