China traders disappointed by a lack of policy rate cuts this week are now shifting focus to a new gauge of borrowing costs for signs of easier monetary conditions.

Market watchers are hoping to see a lower Loan Prime Rate (LPR) released by the People’s Bank of China. Stocks, bonds and the currency tumbled in tandem on Tuesday, following the decision to keep the costs on medium-term loans to banks steady despite slower economic growth across the board. The central bank also held money market rates unchanged on Thursday.

Evidence that a separate measure – a cut to the amount of cash that lenders have to hold as reserves – is feeding through to actual borrowing rates reflected in the LPR will boost the outlook for financial assets. While the PBoC has tweaked policies in recent months to support the slowing economy, it has refrained from more aggressive stimulus out of concern over financial stability and high debt levels.

The LPR is a revamped market indicator of the price that banks charge clients for loans, and is linked to the rate at which the PBoC will lend financial institutions cash for a year. It’s made up of submissions from a panel of 18 banks, though the central bank has a role in setting the level.

The one-year rate was set at 4.25% in August, slightly under the previous mark. It is expected to drop by five basis points to 4.2% this week, according to the median estimate of economists surveyed by Bloomberg. “Investors are growing increasingly anxious as the central bank is already behind the market’s expectation in terms of easing,” said Peiqian Liu, China economist at Natwest Markets Plc, who sees the LPR dropping by five to 10 basis points this week.

“A lower LPR will be interpreted as a sign that liquidity will remain loose and the policy makers have an easing bias.” With central banks around the world turning increasingly dovish, the PBoC’s calibrated approach stands out as Beijing seeks to prevent a bubble in the property market and to curb leverage in the financial industry.

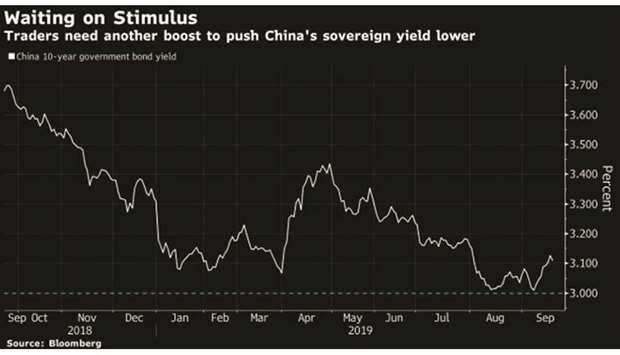

Its reluctance to cut rates has capped a bond rally, as the 10-year sovereign yield trades within its narrowest range in seven years. The stock market has fared better, with the Shanghai Composite Index still up 20% this year thanks to a low base.

China’s lenders may submit lower LPR quotations after the reserve ratio cut that took effect this week released 800bn yuan ($113bn). The move – together with two more narrower cuts planned in the next two months – will lower lenders’ annual funding costs by 15bn yuan, according to the PBoC.

A lower LPR, while expected, will likely be small as a sizeable drop would affect banks’ profitability given the costs for them to obtain PBoC funding remain unchanged, according to Liu.

Investors may grow even more hopeful for monetary easing, betting on the PBoC cutting interest rates to pave the way for lower LPR in the future, said Zhaopeng Xing, a markets economist at Australia & New Zealand Banking Group Ltd. The expectation will spark a rally in bonds, he added.

Chi Lo, a senior economist at BNP Paribas Asset Management, isn’t expecting any swift moves from the PBoC as its aim is to keep increasing liquidity in the system, but at a moderate pace. “Beijing’s game plan is to have a controlled process of selective easing. It’s just sticking with its rule book. Right or wrong, it’s the way it is,” he said.