By Abdullah bin Hamad Al-Attiyah International Foundation

for Energy and Sustainable Development

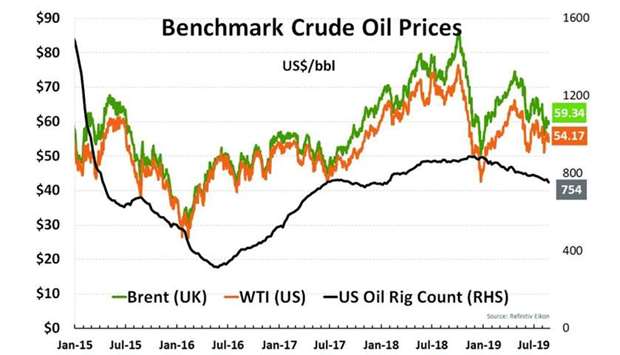

Oil prices fell at the end of last week, after China unveiled retaliatory tariffs against $75bn worth of US goods including crude oil, another escalation of a protracted trade dispute between the world's two largest economies. Brent crude futures fell 58 cents, or 1%, to settle at $59.34 a barrel while WTI crude futures fell $1.18, or 2.1%, to settle at $54.17 a barrel. Over the week, WTI lost 1.3%, while Brent rose 1.2%.

for Energy and Sustainable Development

Oil prices fell at the end of last week, after China unveiled retaliatory tariffs against $75bn worth of US goods including crude oil, another escalation of a protracted trade dispute between the world's two largest economies. Brent crude futures fell 58 cents, or 1%, to settle at $59.34 a barrel while WTI crude futures fell $1.18, or 2.1%, to settle at $54.17 a barrel. Over the week, WTI lost 1.3%, while Brent rose 1.2%.

On Friday, China's commerce ministry said it would impose additional tariffs of 5% or 10% on a total of 5,078 products originating from the US, including crude oil, agricultural products, and small aircraft. In retaliation, US President Trump said he was ordering US companies to look at ways to close operations in China and make products in the US. Investors also focused on a speech by US Federal Reserve chair Jerome Powell at an annual economic symposium in Jackson Hole, Wyoming. The US economy is in a "favourable place" and the Federal Reserve will "act as appropriate" to keep the current economic expansion on track, Powell said. The remarks gave some clues to whether the central bank will cut interest rates at its next meeting. Tensions in the Middle East have kept investors on edge as well. Iran's foreign minister said talks held on Friday with French President Emmanuel Macron about a landmark 2015 nuclear deal were "productive." Iran has said it will scale back compliance with the pact unless the Europeans find a solution enabling Tehran to sell its oil despite US sanctions.

US energy firms last week cut the most oil rigs in four months, with the rig count falling to the lowest since January 2018. Drillers cut 16 oil rigs in the week, the seventh weekly decline in the past eight weeks. The total count was down to 754 from 860 active rigs in the same week a year ago.

Gas

Asian spot prices for LNG held steady last week, supported by demand from Japan where sweltering weather continued, catching some buyers short. Deals for spot October delivery to Northeast Asia were heard at $4.70 mmBtu, slightly below last week's $4.80 per mmBtu. For September delivery, deals were heard at $4.80 per mmBtu and at about $4.60 per mmBtu, both of them purchases made by Tohuku Electric.

With total demand across North East Asia increasing due to the hot weather, Japan's JERA traded six to eight cargoes, including buying one that had been offered by Kuwait Foreign Petroleum Exploration Company (KUFPEC) from its Australian Wheatstone plant and a couple more for prompt delivery.

On the supply side, Freeport LNG, a new facility in Texas owned by private equity and Japanese buyers, began producing its first LNG this month. That makes it the third new US facility to start up this year after Cheniere's second Corpus Christi train and the Cameron LNG plant in Louisiana. Despite these recent starts, the unrelenting supply growth from the US, which upended the global LNG market this year, has slowed in August due to maintenance work at the largest export plant, Cheniere's Sabine Pass.

* This article was supplied by the Abdullah bin Hamad Al-Attiyah International Foundation for Energy and Sustainable Development

US energy firms last week cut the most oil rigs in four months, with the rig count falling to the lowest since January 2018. Drillers cut 16 oil rigs in the week, the seventh weekly decline in the past eight weeks. The total count was down to 754 from 860 active rigs in the same week a year ago.

Gas

Asian spot prices for LNG held steady last week, supported by demand from Japan where sweltering weather continued, catching some buyers short. Deals for spot October delivery to Northeast Asia were heard at $4.70 mmBtu, slightly below last week's $4.80 per mmBtu. For September delivery, deals were heard at $4.80 per mmBtu and at about $4.60 per mmBtu, both of them purchases made by Tohuku Electric.

With total demand across North East Asia increasing due to the hot weather, Japan's JERA traded six to eight cargoes, including buying one that had been offered by Kuwait Foreign Petroleum Exploration Company (KUFPEC) from its Australian Wheatstone plant and a couple more for prompt delivery.

On the supply side, Freeport LNG, a new facility in Texas owned by private equity and Japanese buyers, began producing its first LNG this month. That makes it the third new US facility to start up this year after Cheniere's second Corpus Christi train and the Cameron LNG plant in Louisiana. Despite these recent starts, the unrelenting supply growth from the US, which upended the global LNG market this year, has slowed in August due to maintenance work at the largest export plant, Cheniere's Sabine Pass.

* This article was supplied by the Abdullah bin Hamad Al-Attiyah International Foundation for Energy and Sustainable Development