As SoftBank Group Corp prepares to choose targets for its second technology fund, it’s already winning trust from investors that the company’s debt situation probably won’t worsen.

Billionaire Masayoshi Son’s firm has about ¥7.4tn ($70bn) of debt, among the biggest piles for a Japanese non-financial company, according to data compiled by Bloomberg. SoftBank has committed $38bn of its capital for the second fund. But figures like those haven’t increased concern in the credit market about the company’s finances.

That’s because as the company increasingly takes on more characteristics of an investment firm, SoftBank Group’s debt should be measured in terms of the value of its shareholdings, and by that gauge, its balance sheet is relatively healthy, analysts say. The company also has a policy of not lending to, or guaranteeing loans to, major companies it invests in, limiting its liabilities. SoftBank is a “strict parent” in that regard, requiring units to boost revenue on their own, according to Daiwa Securities Group Inc.

“It may appear to be a risk that a lot of money is being moved around, but it shouldn’t be considered regular debt,” said Mana Nakazora, chief credit analyst at BNP Paribas SA. “SoftBank’s story until now has been of borrowing large amounts numerous times but then taking care of the debt.”

In one sign that the big new investments aren’t sparking credit-market concern, the cost to insure SoftBank Group’s debt against nonpayment has fallen more than 100 basis points this year to 165 basis points, according to credit-default swap data from CMA. SoftBank said the second Vision Fund, which aims to raise $108bn, is expected to collect money from Apple Inc, Microsoft Corp, Foxconn Technology Group and the sovereign wealth fund of Kazakhstan. It’s also won support from Japanese financial institutions, with seven identified as signing memorandums of understanding to participate. SoftBank in June disclosed the first fund had earned 62% returns so far after investing $64.2bn in 71 deals.

To judge its leverage, analysts have been looking at a metric called loan-to-value ratio, which measures net debt against the value of a holding company’s investments. Son has said he wants to keep the gauge below 25%. It was 19% as of Wednesday, according to SoftBank data.

That ratio may worsen due to the second fund, according to Kentaro Harada, a senior credit analyst at SMBC Nikko Securities Inc. It could approach 35%, assuming that money for investment is raised only via debt, he wrote in a report. But SoftBank has said that some of the profit from the first fund will be used to finance the second one, and that the company is intent on keeping the gauge below 25%, Harada added.

Investment timing

To prevent the ratio from exceeding that level, SoftBank may need to sell about ¥3tn of assets over the next four to five years during which the second fund will be in operation, Harada said.

SoftBank Group’s financial policy is to keep the loan-to-value ratio under 25% with an upper threshold of 35%, maintain a cash position that covers bond redemptions for at least the next two years, and secure sustainable distribution and dividend income from SoftBank Vision Fund and other subsidiaries, a company spokesman said.

Investors should seek spreads on SoftBank Group’s bonds to compensate for risks tied to the company’s fundamentals that make its securities sensitive to changes in broad market risk sentiment, CreditSights said in a report. Those factors include a complex capital structure, fund investments that generate little regular cash flow, an aggressive management team, and a financial policy that uses a metric based on equity market valuations, it said.

Despite the big size of the second fund, debt investors should calmly judge its credit impact on SoftBank, considering that it will take time for the investments to be completed, according to Toshiyasu Ohashi, the chief credit analyst at Daiwa Securities in Tokyo. One factor that’s relevant for SoftBank’s credit quality is that SoftBank doesn’t tend to lend to its major units, unlike other Japanese companies that might help out subsidiaries by providing debt funds, he said. The focus instead is on how much its invested firms can generate profits themselves.

“The company’s management style is logical,” Ohashi said.

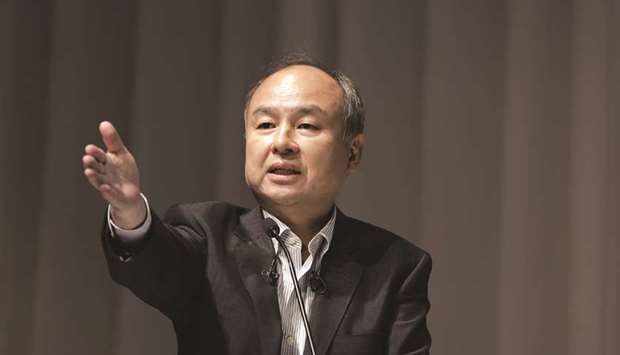

Masayoshi Son, chairman and chief executive officer of SoftBank Group, at a press conference in Tokyo.