One of Germany’s most storied industrial icons just became more Chinese.

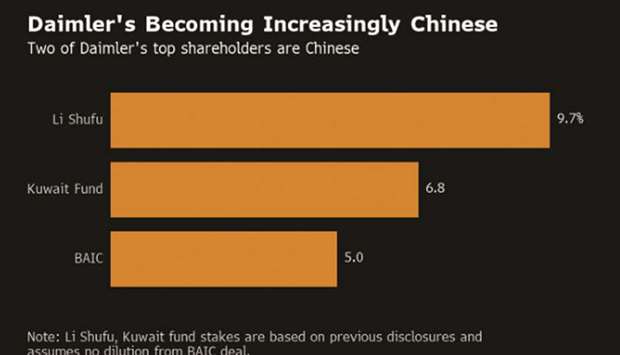

Daimler AG’s Chinese partner, state-backed Beijing Automotive Group Co, is buying a 5% stake in the Mercedes-Benz maker, cementing a more than decade-long alliance of the auto manufacturers. Together with Daimler’s top shareholder – Zhejiang Geely Holding Group Co’s billionaire owner Li Shufu – the transaction would take Chinese ownership in the world’s biggest luxury-car maker to almost 15%.

“This step reinforces our successful partnership and is a signal of trust in the strategy and future potential of our company,” Daimler chief executive officer Ola Kallenius said in a statement yesterday.

Daimler shares rose as much as 4% in Frankfurt trading, after declining 15% in the past 12 months. The company’s stock has come under pressure from four profit warnings in just over a year after markets weakened and the carmaker increased provisions for charges including for the financial fallout from investigations into alleged tampering of diesel emissions in its vehicles.

About half of the stake being taken by BAIC, which is backed by Beijing’s municipal government, is via rights to acquire shares. The 5 percent holding has a market value of about €2.5bn ($2.8bn) as of Monday close.

A Chinese shareholder at one of Germany’s top automotive companies could stir concerns about influence amid a raging trade war that has left global shipments of cars at the mercy of tit-for-tat tariff measures. China and the US are the two largest markets for Daimler’s main Mercedes-Benz cars unit. BAIC’s transaction also raises the question of whether Daimler and BAIC may reorganise their joint venture in China after restrictions for foreign investors in the world’s largest auto market eased.

“Despite all joy about long-term anchor shareholders: we still want to see the Mercedes star and not the Chinese dragon on the hood,” Ingo Speichfrom Deka Investment GmbH said at Daimler’s annual meeting in May. Deka, which represents some 9 million Daimler shares, is against granting BAIC or Geely a seat on the company’s supervisory board due to potential conflict of interest. Chinese investments in German companies have had a mixed record. HNA Group Co. plans to divest its stake in Deutsche Bank AG after becoming the ailing bank’s top investor, marking the unwinding of one of the most high-profile investments made during a multi-year acquisition spree. Last year, Germany blocked a Chinese investor from buying machine tool manufacturer Leifeld Metal Spinning AG after a public backlash over acquisitions by Chinese corporations – such as the Midea Group’s purchase of robot maker Kuka AG in 2016. For its part, BAIC views the purchase as a natural evolution of its relationship with Daimler.

“It has been our intention to strengthen our alliance with Daimler through an investment,” said Heyi Xu, chairman of BAIC. “This step reinforces our alignment with, and strong support for, Daimler’s management and strategy.”

While China is already the world’s biggest car market, it’s coping with its first contraction in a generation, prompting automakers to take steps to expand overseas. For BAIC, maintaining ties with Daimler is strategically important as its joint venture with Hyundai Motor Co has been struggling and its own domestic brands are burning cash as the trade spat with the US is weighing on demand for new vehicles. Co-operation with Western brands gives the Chinese companies potential access to technical expertise and instant credibility as they seek to win over consumers in Europe and the US. “Run by politically-minded management, BAIC is comfortably the lowest quality company under our coverage,” Sanford Bernstein analyst Robin Zhu said in a recent note to clients. With growth slowing and margins squeezed “we’d expect the company’s problems to look increasingly exposed,” he said.

While BAIC is a government-controlled entity, it’s supervised by the Beijing branch of the State-owned Assets Supervision and Administration Commission and doesn’t belong to a group of central state-owned enterprises.

Daimler is exploring additional co-operation projects with Geely, former CEO Dieter Zetsche said at the company’s annual general meeting in May and sought to allay concerns about potential conflicts with BAIC. His successor Kallenius told reporters that month he welcomes long-term shareholders who back Daimler’s strategy.

Geely declined to comment on the deal, saying the Chinese company is committed to a long-term investment in Daimler. Li has sought to harvest synergies from his investments, which include Sweden’s Volvo Cars to improve Geely’s product lineup and move to higher-end models. Geely formed a joint venture with Daimler to transform the German company’s diminutive Smart into an all-electric brand based in China.

Since 2003, BAIC and Daimler have set up a number of co-operations in China, including the joint venture Beijing Benz Automotive Company that produces premium cars in the country, as well as separate entities that make vans and trucks.

Passenger-car sales will probably drop 5% in 2019 in China, researcher LMC Automotive estimated last month as it lowered its outlook for the market for the coming years. German auto-parts maker Continental AG cut its profit forecast Monday. While China’s car retail sales rose in June – the first increase in a year – the gains were helped by heavy discounting and a sustained recovery is far from certain as trade tensions simmer and the economy sputters.

China graph