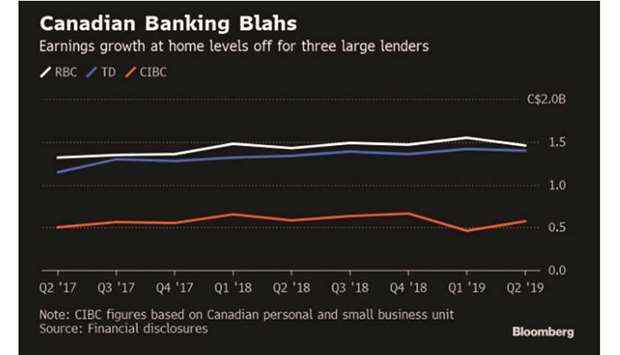

Canadian banking is no longer the engine driving profit growth at the country’s large lenders.

With Canadian financial giants including Royal Bank of Canada and Toronto-Dominion Bank having announced results this week, and rivals to follow, it’s becoming clear that businesses such as wealth management and US operations are doing more to increase earnings than their mainstay of domestic consumer lending.

“Canadian banking has got the blahs,” said David Baskin, whose Baskin Wealth Management oversees assets totalling C$1.2bn ($890mn). “I’m not surprised that the domestic operations are pretty flat. The reason that TD and RBC in particular went south was to find greener fields.”

Much of Canada is experiencing a housing slowdown and household debt is at record high, crimping further borrowing. The country also is a mature market for banking, with lenders getting much of their growth by stealing market share from each other. Canada’s economic prospects are forecast to lag behind those of its southern neighbour.

Gross domestic product in Canada is expected to grow 1.5% this year, compared with 2.6% for the US.

That bodes well for Canadian banks with operations abroad — and less so for those relying on domestic businesses to fuel growth. Bank of Nova Scotia and Bank of Montreal, lenders with significant operations outside the country, report their results next week.

Earnings at Canadian banks’ domestic personal and commercial divisions were expected to rise 5.2% on average from a year earlier, less than the 14.3% increase forecast for their US and international consumer-lending units, RBC Capital Markets analyst Darko Mihelic said in a note to clients earlier this month. At Canadian Imperial Bank of Commerce, which gets a greater share of profits from domestic consumer banking than its peers, earnings from its personal and small business banking division fell 2.4% to C$570mn. CIBC’s biggest profit gains, meanwhile, came from US commercial banking and wealth management, with 18% growth. Canadian mortgages declined, home-equity credit lines were little changed and loan-loss provisions rose from a year ago.

At Royal Bank, earnings rose 2.4% in the company’s Canadian division, its smallest year-over-year growth in five quarters, and far smaller than the 17% jump in RBC Capital Markets earnings and 8.9% surge in wealth management, which includes earnings from Los Angeles-based City National Bank.

Even Toronto-Dominion, with retail-banking operations on both sides of the border, saw a greater boost from the US than from Canada. Earnings from Canadian retail, which includes wealth management, rose just 0.9%, while the bank’s US retail division, including the TD Ameritrade discount brokerage, soared 29%. With a network that stretches from Maine to Florida, Toronto-Dominion has more bank branches in the US than in Canada.

Canadian consumer banking still represents the biggest share of profits at the country’s financial companies, representing almost half of earnings on average for the big banks.

Scotiabank — Canada’s most international bank, with operations in Latin America, the Caribbean and Asia — reports earnings on May 28, and Bank of Montreal, whose non-domestic operations include Chicago-based BMO Harris Bank, follows the next day. Scotiabank analyst Sumit Malhotra has predicted that Toronto-based Bank of Montreal will see its biggest earnings growth from US personal and commercial banking.

Canadian bank