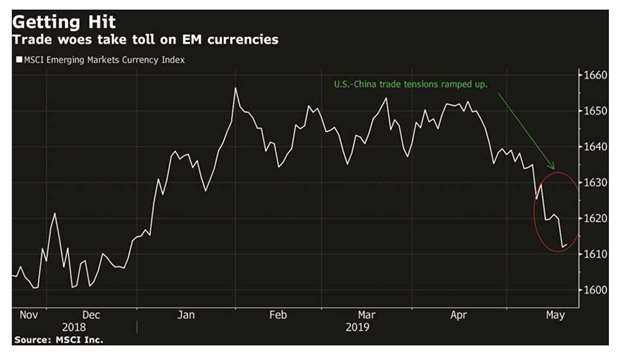

As US-China trade-war rhetoric escalates without any plan for a resumption of negotiations, currency strategists are mapping out foreign-exchange implications.

Bank of America Corp sees the Japanese yen strengthening as investors flee risky assets, and has recommended an associated euro-yen trade. Goldman Sachs Group Inc warns that currencies from the euro to South Africa’s rand and Chile’s peso could be in the firing line. And Westpac Banking Corp sees bonds as a safe bet.

“It’s probably one of the most underappreciated things in this market – this FX question” about the impact of trade tensions, said Thomas Costerg, an economist at Pictet Wealth Management in Geneva.

Some Asia-Pacific exchange rates are already seeing an impact, edging closer to key technical levels as fallout from the trade war spreads. South Korea’s won has lost around 4% against the dollar in the past month, while the Aussie is approaching its January flash-crash low of 67.41 US cents. The Indonesian rupiah has lost almost all its gains for the year.

Biggest losers

“Taiwan and South Korea have the most to lose if things intensify,” said Richard Franulovich, Westpac’s head of FX strategy in New York. The won and Chinese yuan, along with the Taiwan, Australian and Canadian dollars, “are all exposed,” and the euro “would fall pretty dramatically,” he said. For downside protection, he advised shorting these currencies or owning the bonds in their markets.

That said, Franulovich reflects the consensus view in markets that the US and China will in the end reach “some kind of deal.”

Over at Bank of America, the currency team last week initiated a three-month put spread that takes a short position on the euro-yen currency pair, with the view that investors will be seeking a haven with no quick US-China deal in the offing.

“Almost all the uncertainty and related risks markets were facing as the year started remain, and in some cases got worse,” Athanasios Vamvakidis, BofA’s head of G10 FX strategy, wrote in a note. “All this makes FX extremely challenging. For now, we are taking the view that things can get worse in the short term.”

Zach Pandl, Goldman Sachs’s co-head of global FX and EM strategy, said he sees the potential for trade tensions to spill over into currencies including the euro, South African rand and Chilean peso. He sees the euro in particular having downside risks, saying it should head lower in the short term to $1.10, from the current level around $1.1164.

Lurking in the background is the risk of yuan depreciation. If China proceeds to impose tariffs on some $60bn of American imports starting June 1, and the US doesn’t pull back on its own 25% tariffs, “there will be an obvious temptation for China to allow the CNY to depreciate,” BofA’s Vamvakidis said. “Even optimists need to consider the CNY risk scenarios given the current circumstances and risks.”

Costerg at Pictet advises keeping an eye on one wild card. With the current focus on the US-China impasse, the Trump administration’s disputes with Europe and Japan over auto trade have been put on hold. But tariff imposition there could open the door to full-fledged protectionism across the board, he said.

“It could be messy,” Costerg said. “The trade side has to have repercussions for the FX side, with more volatility in the market.”