Capital flows to emerging markets (EM) have seen a clear rebound in the first quarter after suffering in 2018 due to tight global financial conditions and dollar appreciation, QNB has said in an economic commentary.

QNB expects portfolio capital flows to EM to be higher in 2019 than 2018 as the US Federal reserve has shifted to a neutral stance and investors become less risk averse.

The Institute of International Finance (IIF) compiles trackers of portfolio capital flows, which cover daily real money flows into the stocks and bonds of twenty large EMs. The trackers are a good indicator for the portfolio flows component of the official balance of payment (BoP) data, which are released much later.

Historically there have been two main drivers of portfolio capital flows to EM: interest rates and economic growth, QNB noted. Higher interest rates and growth in EMs, relative to advanced economies, tend to attract capital as EMs offer higher returns to investors.

Higher relative interest rates naturally attract foreign investment in interest-bearing assets such as bonds. Whereas, stronger economic growth has traditionally drawn investors to equity investment on prospects of higher future profitability, QNB said.

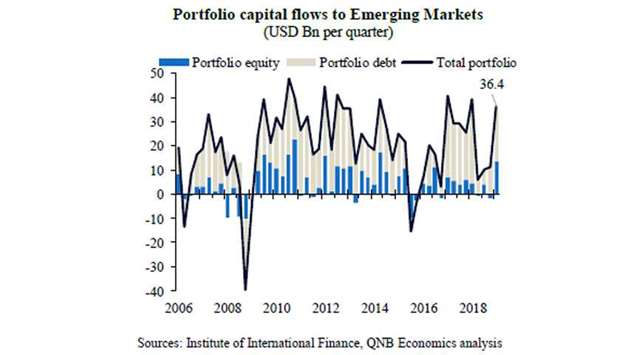

Since the 2009 global financial crisis, there have been three notable periods when portfolio capital flows to EMs weakened or reversed.

The announced tapering of quantitative easing in May 2013 led to tighter financial conditions in EMs. Many EMs have high levels of dollar debt. Weaker EM currencies increased the cost of repaying and servicing this debt, forcing EMs to deleverage. All these factors dragged on growth.

In 2015, Chinese policies aimed at reducing the buildup of debt in the shadow banking system threatened to slow GDP growth too sharply and risked causing a disorderly devaluation of the renminbi. In the seven months from July 2015, $70bn flowed out of EMs due to fears of a hard landing in China. EM outflows peaked in January 2016 at $16bn as risk off sentiment in global financial markets intensified.

However, capital flows began to recover in 2017 as China managed to sustain growth and fiscal stimulus in the US drove a pick up in global GDP growth.

In 2018 global financial conditions tightened and the dollar appreciated amidst rising political risks and much weaker economic performance in the euro area and Asia.

Portfolio capital flows to EM fell from an average of more than $31bn per quarter in 2017 to less than $17bn per quarter in 2018. Even China, a key part of the 2017 EM rebound, started to decelerate as domestic policies were less supportive and trade jitters with the US dented business and consumer confidence.

QNB noted that 2019 has already seen a rebound in portfolio capital flows to EM to $36bn in the first quarter. However, only a small number of emerging markets have seen a convincing rebound in flows, with Indonesia perhaps the prime example.

Whereas, some large EMs like South Africa, Thailand and Malaysia have seen continued outflows. Elections in Thailand, Turkey, South Africa and India during the first half of 2019 represent political risk for investors.

Lower political risk after these elections should support portfolio capital flows during the rest of the year.

The IIF uses its trackers of portfolio capital flows to inform their projections of non-resident capital flows to EM. The IIF expects only a modest pickup of non-resident capital flows to EM from $1.14tn in 2018 to $1.26tn in 2019.

It argues that years of low interest rates and quantitative easing by major central banks have left global investors with a large share of their portfolios already allocated to EMs, leaving little room for them to increase their purchases of EM assets, QNB said.

“Rather, we expect non-resident capital flows to EMs to pick up more strongly than the IIF for two main reasons. First, we believe that higher growth in EMs than advanced economies will allow them to continue to supply investor with assets offering attractive risk-adjusted returns. Second, our view on global GDP growth is more optimistic than theirs,” QNB said.

The US Federal Reserve has become more “dovish”, QNB noted. “We are optimistic about a partial US-China trade deal. Policy stimulus in China is beginning to bear fruit, which will have a positive knock-on impact on other EMs. These three factors are driving an improvement in financial market sentiment, which will particularly benefit more risky assets like EM debt and equity,” QNB said.