A widening trade balance increases the risk of President Donald Trump escalating the trade war particularly with China again in the run up to his bid for re-election in 2020, QNB has said in its weekly economic commentary.

Global current account imbalances have been a key issue in policy debate over the past few years. Many observers have singled them out as a key factor contributing to the 2009 global financial crisis (GFC).

Current account surpluses in several economies (particularly China) are said to have helped fuel the credit booms and risk-taking in the major deficit countries at the core of the crisis (particularly the US), by putting significant downward pressure on world interest rates and helping to finance booms in those countries, QNB said.

The trade balance measures a country’s imports and exports. The trade balance is the largest component of the current account, which is itself the largest component of the balance of payments.

Imports are any goods or services produced in a foreign country, even if all the imports are being sold by, and generating profit for, a domestic firm.

So, globalisation, the rise of multinational corporations and job outsourcing are all contributing to the growth of international trade, QNB said.

A trade deficit results when a country imports more than it exports. In 2018, the United States traded $5.6tn with foreign countries. That was $2.5tn in exports and $3.1tn in imports.

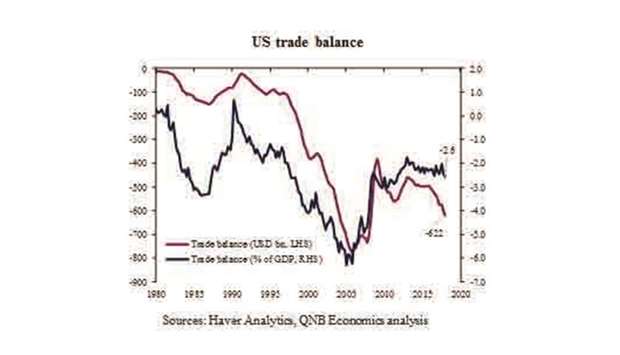

The US trade deficit widened to $622bn in 2018, up sharply from $552bn in 2017. US imports were 8% higher in 2018 than 2017.

Solid domestic demand, fiscal stimulus, and capacity constraints combined to keep a steady pull on imports. US exports were 6% higher in 2018 than 2017. Despite a strong start to 2018, export growth faded in the back half of the year amid softening global growth, slowing trade, and protectionist measures. Overall, net trade caused a 0.2ppt drag on US GDP growth in 2018.

The size of the US trade deficit is part of President Trump’s motivation for imposing tariffs and other protectionist trade measures, currently focused on China, QNB noted.

However, the trade deficit has been broadly stable since 2009 at between 2 and 3% of GDP, which compares to an average of 2.5% since 1980.

“Therefore, the trade balance does not suggest to us that the US or global economies are as vulnerable as they were in the years leading up to the 2009 GFC. We now consider four main factors driving the US trade balance: competitiveness, domestic demand, currency strength and oil,” QNB said.

US competitiveness is supported by relatively cheap energy supplies, leading research and development and the deepest financial markets in the world.

However, many other countries (e.g., China and Mexico) have lower labour costs, making them more competitive relative to the US, particularly in manufacturing of consumer goods and automotives. Improving US competitiveness relative to foreign countries would boost exports and constrain imports, improving the trade balance.

The US economy grew 2.9% in 2018, matching its “strongest” performance in over a decade. Strong domestic demand (private consumption and investment) was fuelled by fiscal stimulus delivered mainly via tax cuts.

Stronger domestic demand boosts imports by more than exports, weakening the trade balance. For the past few years US domestic demand has been a more important driver of the global economy and external demand, thus contributing to the widening of the US trade deficit.

The relative strength of the US economy has also contributed to the strength of the dollar, which remains very strong against a trade-weighted basket of foreign currencies. Currency strength negatively impacts the trade balance because it makes imports relatively cheap for domestic consumers and exports relatively expensive for foreign consumers.

Historically, the US has imported a lot of oil. So, when oil prices rose, so did the trade deficit. However, more recently the tapping of US shale oil has significantly reduced US dependence on oil imports.

So, now the US trade deficit is smaller than it would have been without shale oil and is much less sensitive to the oil price as the US moves towards self-sufficiency, QNB said.

Despite the Trump administration’s best efforts, softer global growth and protectionist trade measures will depress export momentum, while relatively healthy domestic demand and a stronger dollar keep a steady pull on imports.

“As the pace of imports outstrips exports, the trade balance is expected to widen to around $650bn and therefore net trade is likely to impose around a 0.3ppt drag on real US GDP growth this year,” QNB said.

Business / Business

Widening trade balance raises risk of Trump escalating tariffs war with China: QNB

graph