Chinese developers are finding Hong Kong’s housing market a tough nut to crack.

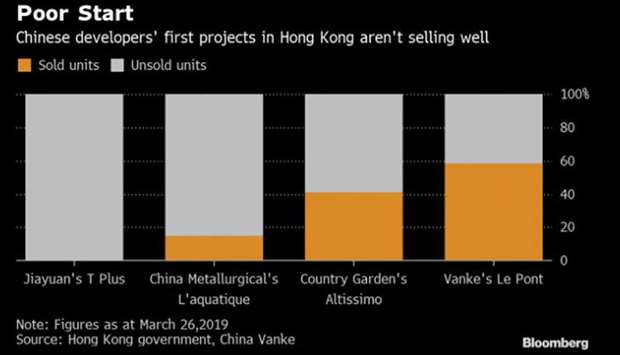

Country Garden Holdings Co, one of the mainland’s largest builders with sales of more than 500bn yuan ($74bn) last year, has offloaded just 40% of apartments at its beachfront Altissimo project since it opened in November.

Jiayuan International Group Ltd has struggled even more, finding buyers for only two of the 356 units at T Plus, even though sales started more than three months ago. The development has attracted criticism for offering the city’s smallest apartments, measuring just 128 square feet (12 square meters).

The Chinese developers, which started snapping up Hong Kong land three to four years ago, have been hit by a confluence of issues. They lack name recognition among buyers more familiar with dominant Hong Kong developers like Sun Hung Kai Properties Ltd and Sino Land Co. They also priced their apartments too high just as the city’s booming property market hit a soft patch, with values falling for most of the last four months of 2018.

“Buyers are more familiar with developers from Hong Kong,” said Patrick Wong, a real estate analyst at Bloomberg Intelligence. “They have more confidence in buying apartments from these local brands, especially when units can now easily fetch HK$10mn ($1.3mn).”

Inexperience in the local market when setting prices contributed to slow sales, while remote locations of some of their projects also damped buyers’ interest, said Wong. Jiayuan’s T Plus development is more than an hour’s bus ride from Hong Kong’s central business district. China Vanke Co has managed to buck the trend. By pricing apartments at its Le Pont project competitively – prices were 20% lower than nearby developments – it has managed to sell about 60% of the units since October.

Despite the setbacks, developers from north of the border will continue to ramp up their presence in the city. An index of secondary private residential property prices in the city on Friday posted its seventh-straight weekly gain.

“They regard Hong Kong as a mature market with large population growth, when it’s difficult for them in tier-three or tier-four cities in mainland China,” said Wong. “There are good prospects in Hong Kong.”

GRAPH-2