A Japanese lender has this year bought the lion’s share of top-rated bonds that are backed by pools of European corporate loans, propping up the region’s market for collateralised debt obligations amid a very difficult first quarter.

Norinchukin Bank, starved of yields thanks to Japan’s negative interest rates, is expected to keep buying AAA-rated tranches in Europe until at least the summer, even as Japanese authorities scrutinise how the region’s financial institutions operate in the global CLO market.

“The Japanese bid for AAAs remains strong and there are no signs of them pulling back anytime soon,” Aza Teeuwen, a portfolio manager at TwentyFour Asset Management LLP, said in a March 20 client note.

He added that equity investors need this bid at the moment “as arbitrage is far from ideal.”

This has provided a boon to those managers able to bank on the certainty of selling the biggest slice of bonds from their CLO. Consequently, Norinchukin’s participation has kept deal flow moving in Europe, helping arrangers to clear away the backlog of older, uneconomical vehicles from their balance sheets.

A spokesman for the Japanese lender declined to comment on its investment policy.

Ten out of this year’s 15 new issues have been anchored by Norinchukin Bank, equating to a 66%% hit rate in the first quarter. This follows a particularly active second half for the bank.

But without the bank’s investments European managers would have struggled even more to print deals this quarter. New issue spreads at the top of a vehicle’s liability stack would undoubtedly be higher, putting yet more pressure on managers looking to balance funding costs with cash flows from the underlying loan assets. The advantage of “Nochu” is that it is there throughout the cycle, according to a London based CLO manager.

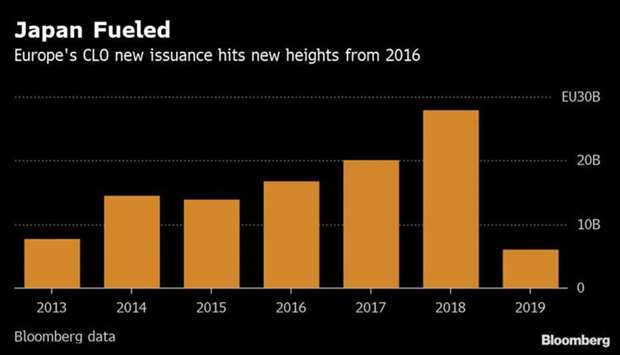

The entry of Japanese banks into Europe a little over three years ago marked an expansive phase of the post-crisis market for CLOs. From roughly €14bn ($15.8bn) in 2015, supply soared to €20bn in 2017 and reached almost €28bn last year, according to data compiled by Bloomberg.

Norinchukin works with a pre-approved list of managers, providing all or almost all of the AAA tranches for these issuers at a predetermined price.

That list has expanded recently to as many as 16 of the region’s 46 issuers. 10 of those are said to have tapped into the investor during the first quarter to anchor their AAA-rated paper, amounting to roughly €2.5bn based on an average AAA tranche size of €250mn.

These managers benefit from being able to lock in the coupon on the triple-A rated tranche ahead of pricing to protect against any volatility, as well as securing liability costs that are inside spreads offered by other investors.

Nochu has set the level for AAA pricing this year as the cheapest buyer in the market. European issuers working with Nochu this year have priced their senior AAA-rated tranche at 108-108.5 basis points, although in return managers say they have to price within a specific window and agree to more restrictive terms. Issuers away from Norinchukin have priced their most senior tranche wider at 114-116 basis points.

Its presence also benefits those not on its platform, since it frees up other investors for these deals, and also contains spreads, according to a CLO manager based in London.

Norinchukin’s dominance of Europe’s CLO AAA market has drawn concern from some loan arrangers about the market’s over-reliance on one investor, and the potential for AAA spreads to widen if such a large buyer stepped back from the market.

While that might hamper future supply – and make it harder to refinance the underlying loan assets – existing CLO investments are locked up for the life of the vehicle, removing any material impact on the current market. In addition, the more conservative stance the likes of Nochu adopt with respect to CLO deal documentation benefits debt investors in the form of greater protections.

The current concentration will however be diluted as the year progresses, and as managers with with other investors bring deals to market. Just five managers have syndicated their top-rated tranches among a broader range of investors so far this year, but more are in the pipeline.

Last year’s statistics show that of the 40 issuers that priced 66 new transactions in 2018, roughly half syndicated their AAA-tranche to the non-Japanese (or “syndicated”) investor base, which includes European commercial banks, insurance firms, pension funds, as well as some US banks.

This year’s new issuance has been front loaded with Nochu deals because deals with better execution capacity have jumped to the front of the queue, but more syndicated transactions will emerge during the next quarter, the CLO manager said.

Nochu isn’t the only Japanese bank with a presence in the European CLO market. Mitsubishi UFJ Financial Group, Daiwa Next Bank and Sony Bank are among those who have also invested in the region’s AAA debt tranches in recent years.

Japan Post Bank Co – which has been active in the US market doubling its CLO portfolio to 1tn yen since March 2018 – is a conspicuous absentee from Europe’s primary market, although managers say they would welcome more competition in the form of another anchor investor.

graph