When HNA Group Co became Deutsche Bank AG’s top shareholder in early 2017, the German lender’s shares were trading near two-year highs and the once-fledgling Chinese airline was voicing ambitions of turning into a big player on Wall Street.

Then both firms ran into roadblocks.

HNA has since lost its seemingly insatiable appetite for growth, embarking on a selling spree after debts spiralled out of control, while Deutsche Bank shares tumbled by more than half to record lows after investors lost faith in its turnaround strategy.

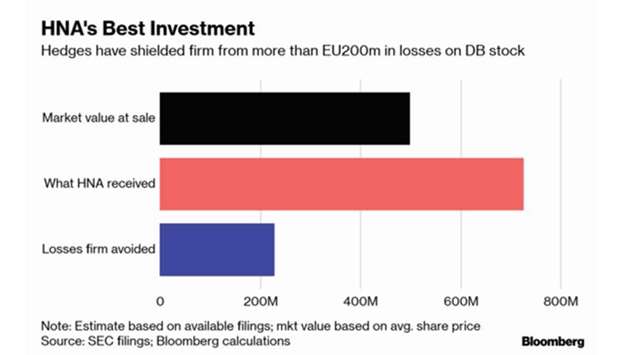

Fortunately for the Chinese investor, most of its German holdings were hedged against losses, allowing the firm to unload some shares this month at €16.70 apiece – more than double Deutsche Bank’s latest price.

The hedge is one of many that have saved the Chinese company hundreds of millions of dollars, making them some of the group’s best investments.

Despite that, HNA’s foray into Germany’s biggest bank hasn’t been profitable and the Chinese group continues to pursue disposals after agreeing to unload more than $20bn of assets since 2018.

“HNA needs to continue to sell non-core assets such as Deutsche Bank,” said Alex Wong, Hong Kong-based director of asset management at Ample Capital Ltd. “It’s still key for HNA to streamline its business.”

HNA, which once held almost 10% of Deutsche Bank, plans to eventually dispose of its entire stake, people briefed on the matter have said.

The latest sale involved HNA’s C- Quadrat unit exercising options to sell Deutsche Bank shares for €363mn ($410mn), reducing its ownership to 6.3%, according to a filing with the Securities and Exchange Commission. HNA isn’t the only high-profile Chinese investor appreciating its decision to hedge.

Zhejiang Geely Holding Group Co’s billionaire chairman Li Shufu agreed to become the biggest shareholder in Daimler AG about a year ago through collar trades which include both call and put options that limit gains and losses.

Shares of the maker of Mercedes-Benz cars have fallen by more than 25% since his stake was disclosed.

The market for collars and other equity derivatives has grown recently as rising stock markets prompted rich individuals and firms to protect their gains.

The business, which includes margin loans, generated an estimated $3.5bn in revenue for the 12 biggest banks in 2017 and has been lucrative for Wall Street because the products are complex, tailored specifically for each client and aren’t always traded on exchanges.

Deutsche Bank ended 2018 as the worst-performing European lender, hitting a record low on December 27.

Though the bank has bounced back this year, most analysts have a sell recommendation on the stock amid concerns about the its outlook, according to data compiled by Bloomberg. High funding costs are threatening the lender’s turnaround efforts while the share price decline and job cuts have prompted questions about whether Deutsche Bank needs to be combined with a German competitor.

The bank is also awaiting the outcome of US probes, including into whether it helped wealthy Russians launder billions of dollars in illicit funds, while Democrats have begun digging into the bank’s relationship with President Donald Trump.

Deutsche Bank’s ownership is shifting too.

A US hedge fund run by former JPMorgan executive Doug Braunstein recently unveiled a stake of just over 3%.

HNA has long been a controversial shareholder for Deutsche Bank.

Former chief executive officer John Cryan initially refused to meet with its executives, people familiar said at the time.

He eventually relented when the issue fuelled tensions with his chairman Paul Achleitner, who was personally involved in the effort to attract the investor.

The bank’s supervisory board includes Alexander Schuetz, the chief executive officer of C- Quadrat Investment Group, which manages HNA’s stake in Deutsche Bank and is owned by the Chinese Group.

Graph