Nickel bears have been sent running for cover by this week’s ferocious squeeze on the London Metal Exchange (LME).

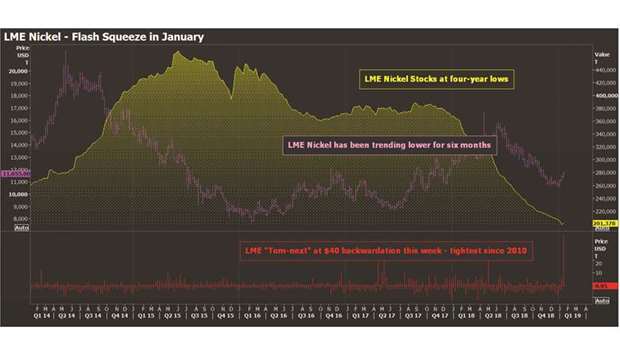

Short-dated time-spreads have flexed out to levels not seen in many years as a long-running decline in LME nickel stocks translates into cash-date tightness.

The resulting bear rout has halted a six-month downtrend in the outright nickel price.

Bulls, however, should not get overly excited.

There is as yet scant evidence this was anything other than a flash squeeze rather than a signal for higher prices.

But that is not to say there won’t be more such spread tension in the nickel market going forward.

That nickel should be squeezed this week is no accident.

Today is the LME’s “third-Wednesday” prime prompt date, the monthly clear-out of outstanding positions.

And there were a lot of short positions to be covered.

LME broker Marex Spectron estimates that funds were net short of nickel to the tune of almost 20% of open interest coming into January.

Speculators were surfing a downtrend that saw LME three-month nickel slide from $15,845 per tonne in June last year to an early-January low of $10,525.

All that time, however, LME stocks were falling. Registered inventory slumped by 44%, or 160,212 tonnes, over the course of 2018 and last Friday the headline figure fell through the 200,000-tonne level for the first time since 2013.

Live stocks, stripping out the metal earmarked for physical load-out, totalled 142,788 tonnes at the end of last week, the lowest level since early 2014.

This shrinking physical liquidity base was always going to cause problems for short-position holders at some stage.

It doesn’t help that what is in the LME storage system is tightly held.

The exchange’s positioning reports showed one entity holding between 40% and 49% of live stocks ahead of this week’s showdown.

The resulting tension between shorts and longs has seen a blow-out in “tom-next”, the LME’s shortest-dated spread.

What is in effect the cost to a short-position holder of rolling that position a single day shot out to $40 per tonne on Tuesday, a degree of tightness not seen since 2010, according to analysts at Citi.

Cash-date tightness has in turn compressed the whole front end of the forward nickel curve.

The benchmark cash-to-three-months LME spread has tightened from a contango of $88-per tonne at the start of January to just $9 as of Tuesday’s close.

There are already signs that the squeeze is abating as the market transitions through this week’s third-Wednesday cash settlement.

“Tom-next” has retreated from a backwardation of $9 at Wednesday morning’s opening to a small contango of $0.95 at the last trade.

That should translate into a looser cash-to-three-months spread structure.

Longer-dated spreads, meanwhile, have been largely undisturbed by this week’s cash-date tightness.

The three-to-15-months spread is at $310 contango, according to Citi, which is “wide by historical standards”.

“Such an inconsistent pocket of tightness at the front tends to most often be associated with a short-term imbalance between the shorts and longs around a particular expiry,” it notes. (“Nickel spreads tighten at record pace on a sharp roll, but it’s too soon to call fundamental”.

Flat physical premiums in particular argue against this week’s LME squeeze being reflective of a shortage of available metal in the world beyond the exchange’s trading floor.

There are, moreover, good reasons to worry about the health of the stainless steel sector, still the largest user of nickel.

Global stainless production growth braked sharply from almost 13% in the first half of 2018 to just 5% in the third quarter, according to the most recent statistical update from the International Stainless Steel Forum.

Most analysts think output growth has slowed further since then, clouding nickel’s own prospects.

Citi’s base case scenario, for example, is for “a fairly balanced (nickel) market in 2019”.

The only consistent bull signal right now is the long-running drawdown in visible LME stocks. It’s a highly problematic signal, however.

The consensus view among nickel market commentators is that the huge draw on LME nickel stocks last year was not metal being shipped into a tight physical market but rather metal being stockpiled in off-exchange warehouses.

It’s maybe no coincidence that LME stocks started disappearing towards the end of 2017, the year that saw nickel galvanised by the electric vehicle story.

Lithium-ion batteries still account for only a small part of annual nickel usage but the ratio is only going to increase as vehicle electrification gathers momentum and nickel eats into higher-cost cobalt’s usage in batteries.

It was precisely such electric dreaming that helped nickel ascend those June 2018 highs before the market was swamped by the macro-economic negativity already dampening other base metals.

Nickel’s new electric narrative also seems to have triggered hoarding of physical units.

Given the relative costs of LME and non-LME storage, such physical stock holders wasted no time in moving their metal to non-registered warehouses.

As speculative shorts have found out to their cost this week, the existence of such off-market stocks is no consolation to those having to roll positions on the LME.

However, holders of those stocks are also LME short-position holders, assuming they are hedging their price exposure.

And it may be these positions that were specifically targeted by predatory longs this week.

If so, this week’s flash squeeze may turn out to be a taste of things to come.

There is already a template for this sort of recurring flash squeeze in the aluminium market.

It too has high but largely off-market stocks, with stock holders regularly clashing with long-position holders in the tighter physical liquidity space of the LME system.

The result has been a long-running series of cash-date squeezes with extreme bouts of tightness pulling metal into the LME system only for it to turn around and head back out as soon as the squeeze dissipates. All the evidence suggests this particular nickel squeeze will be over within a few days. But, if nickel is indeed starting to resemble aluminium, it surely won’t be the last squeeze this year.

Andy Home is a columnist for Reuters. The opinions expressed here are those of the author.

Graph