A Reserve Bank of India panel may recommend the central bank transfer its surplus capital to the government in tranches, according to a person familiar with the discussions.

Members of the expert committee on the economic capital framework are discussing how much of the RBI’s excess funds can be given to the government, the person said, asking not to be identified because the talks are confidential.

If the surplus is transferred in instalments over two to three years, the matter won’t be as politicised, the person said.

The committee, headed by former central bank governor Bimal Jalan, held its first meeting on January 8.

Prime Minister Narendra Modi’s administration is pressuring the RBI to transfer more of its cash to the government to help fund spending pledges and shore up voter support ahead of elections due by May.

The issue has been a source of tension between the central bank and the government, and was seen as one of the key reasons why Urjit Patel quit as governor last month.

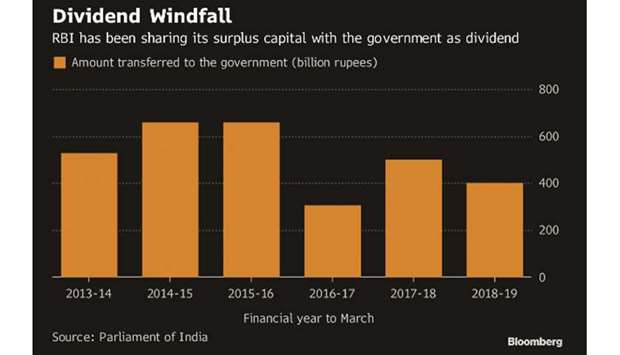

The RBI earns profits from its investments and printing of notes and coins, which it pays as dividend to the government every year.

A small part of the gain is retained as capital reserves.

The Finance Ministry estimates that the central bank is holding Rs3.6tn ($51bn) more capital than it needs, based on global metrics followed by central banks in the UK and US. A spokesman for the RBI declined to comment.

DS Malik, a spokesman for the Finance Ministry, didn’t respond to calls on his mobile phone.

Some members of the panel are of the view that benign inflation and low crude oil prices make this an appropriate time to transfer the surplus capital, which the government can use to revive investment and boost the economy, the person said.

The RBI panel is likely to meet again later this month to reach consensus on the right amount of capital the central bank needs to maintain financial stability in the country.

It has about three months to submit its report, but may do so earlier than that.