US President Donald Trump unleashed chaos in the global trading system in 2018 with his crackdown on countries he says trade unfairly. His tariffs contributed to a deep selloff in global markets and prompted economists to slash their forecasts for trade. Trump wants to punish countries he says charge unreasonably high duties, steal American technology, subsidise industries and dump cheap products in America. The US levies disrupted supply chains and raised prices for manufacturers and consumers, could crimp economic growth and may undermine the World Trade Organisation, the international body that negotiates, monitors and mediates trade rules.

1. Why did Trump invite this fight?

He routinely points to the large US trade deficit, the difference between imports and exports, as a symbol of a declining manufacturing base and the loss of American might. He aims to reduce the goods-and-services gap, which totalled $566bn in 2017, by both browbeating and enticing US companies to import less and export more.

2. What has he done?

He first imposed tariffs (which act like a tax on imports) on foreign-made solar panels and washing machines shipped into the US. Then he levied duties on steel and aluminium from most countries, including allies Canada, Mexico and the European Union, which retaliated with tariffs on US goods. In stages, Trump proceeded to slap duties on $250bn of goods from China, including furniture and food, and said he’d consider adding goods worth $267bn to the hit list. All told, Trump imposed or threatened tariffs on virtually all products from China, which struck back with duties on almost all US goods entering the country.

3. Will Trump’s strategy work?

It depends on who blinks first and whether US trading partners offer to cap their exports or meet US demands. Trump’s threat to abandon the North American Free Trade Agreement prompted Canada and Mexico, the two other signatories of that treaty, to agree to revisions. Tariffs on metals and threatened duties on cars had the EU and Japan also looking to deal. Getting China to bend has proven harder, as the US is seeking fundamental changes in how the Chinese government manages its economy via subsidies and state-owned enterprises. Meanwhile the US trade deficit widened in 2018, partly because the stronger dollar made US exports pricier.

4. What’s the economic effect?

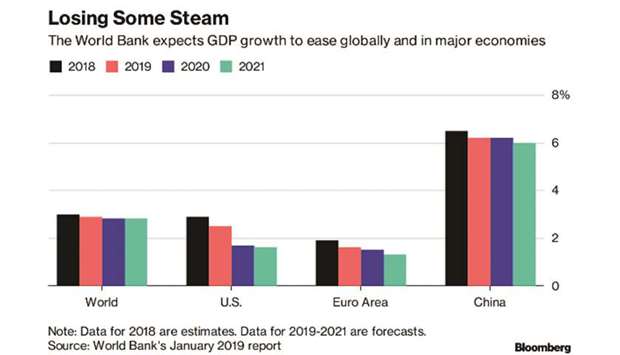

That’s still playing out. In the US, the trade war alarmed business leaders, who largely support existing trade deals. As of mid-2018, however, US economic growth remained buoyant, with economists partly crediting Trump’s tax cuts. The International Monetary Fund cut its forecast for global growth in 2018 and 2019 by 0.2 percentage point, in part blaming trade tensions.

5. How about in China?

The trade fight came at a time when the Chinese economy was already slowing, and in September it helped push the country’s benchmark stock gauge to its lowest level since 2014. Should Trump apply all threatened tariffs, the fallout would shave 1.5 percentage points off China’s economic growth, Bloomberg Economics estimates. The tensions also dragged down other Asian financial markets, including those in India and Indonesia.

6. Who are some of the winners?

Metals tariffs have helped producers that have American plants, such as ArcelorMittal, US Steel and Nucor. They’re charging higher prices, and some have reopened shuttered sites. Some businesses in Southeast Asian nations expect China’s pain to be their exporting gain, among them Vietnamese furniture producer Phu Tai Corp, which makes home furnishings for Wal-Mart Stores Inc outlets in the US.

7. And some of the losers?

As Trump intended, Chinese exporters are feeling the squeeze. The products hit by Trump’s initial tariffs could be replaced by other goods, meaning exporters must cut prices to keep buyers, according to a report by research network EconPol Europe. Caterpillar, General Motors, Harley-Davidson and other US manufacturers say tariffs have pushed their costs up as well, hurting profits. Harley-Davidson Inc said it’s shifting some production overseas. US farmers have needed $12bn in government bailout funds. Apple Inc cut its revenue outlook after sales of the iPhone in China were weaker than expected, which chief executive officer Tim Cook attributed partly to growing trade tensions. FedEX Corp CEO Fred Smith blamed “bad political choices,” including Trump’s tariffs, for hurting the company’s profits.

8. Can’t the WTO resolve

the dispute?

Both the US and China justify their tariffs under domestic laws. That could limit the global trade body’s ability to mediate.

Graph