The performance of nearly $340bn of Eurobonds in the Gulf Arab region depends on what the Federal Reserve does next.

Securities from the Gulf Co-operation Council are poised for their worst year since 2013, and could face another painful 12 months if the US maintains its pace of rate increases. That, and the risk of more declines in oil prices, will keep investors on tenterhooks, although inclusion in JPMorgan Chase & Co’s emerging-market bond indexes starting January will likely attract billions of dollars.

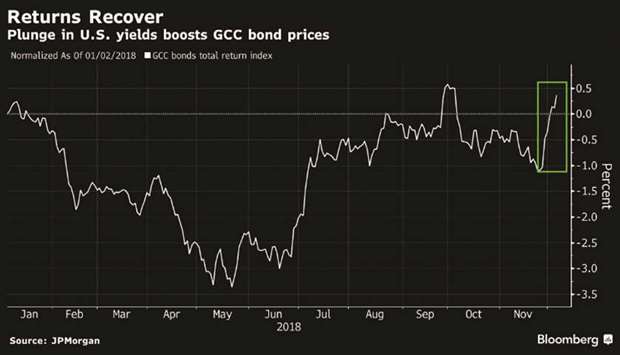

The good news is that investors are now reducing bets on the number of rate increases in 2019 as they weigh the prospect of slowing global economic growth, fading US fiscal stimulus and volatile financial markets.

Gulf bonds have returned an annualised 0.6% this year, compared with a 4.6% loss for emerging markets, according to JPMorgan gauges. Debt from the GCC has gained all but one year since the index was created late 2001.

Most currencies in the GCC are pegged to the dollar.

A few ugly scenarios

If US economic growth is stronger than elsewhere, then 2019 will be very similar to 2018; the dollar will be strong, rates will continue to rise and EM will have a difficult time with the GCC again marginally outperforming because of its pegged currencies, says Abdul Kadir Hussain, the Dubai-based head of fixed-income asset management at Arqaam Capital Ltd.

If the rise in US Treasury yields is significant, “the GCC and Asia will most likely be the worst hit,” says Sergey Dergachev, senior portfolio manager at Union Investment Privatfonds GmbH in Frankfurt, Germany.

A significant decline in oil prices to $45 to $50 a barrel, will definitely be negative for GCC debt, says Dergachev.

The bright side

n Inclusion in JPMorgan’s emerging-market bond indexes will be a “significant driver” for GCC debt because it will bring “billions of dollars of foreign investment to the region,” according to Mohieddine Kronfol, Franklin Templeton Investments’ Dubai-based chief investment officer for global sukuk and Middle East and North Africa fixed income. He sees Gulf bonds outperforming EM peers.

n GCC bonds will also be helped by regional economies expanding at 2% to 3%, and expansionary government budgets and stimulus, says Kronfol.

n The GCC will remain relatively resilient to an escalation of problems in the Eurozone, says Dergachev.

n If US economic growth slows, then interest rates will begin declining and “your best asset class will be Treasuries and suddenly duration is going to be your friend.” Duration and high-grade bonds will outperform shorter duration and high-yield bonds, says Hussain.

n Positive geopolitical developments “can be quite beneficial, as we know from the impact of easing tensions between the US and Turkey and so if Qatar and Saudi Arabia begin to ‘agree to agree,’ both should benefit, says Richard Segal, senior analyst Manulife Asset Management Ltd in London.

Graph 2