A deluge of misfortunes has left China’s equity investors with their biggest losses in years, wherever you look.

Stung by everything from a national vaccine scandal to a decline in consumer spending, the Trump administration’s crackdown on Chinese tech and Beijing’s tightening grip on education, gaming and drugs, the country’s stock market has lost $2tn in value in 2018.

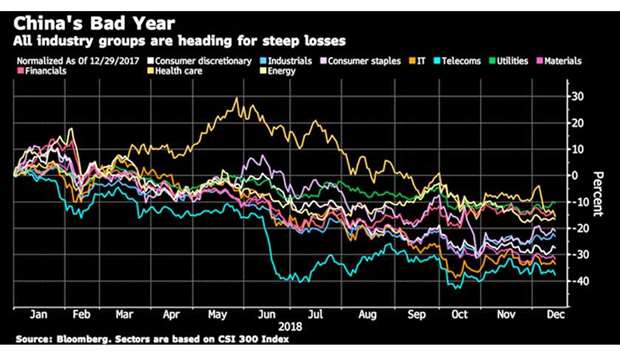

Languishing in a bear market, all 10 industry groups on the CSI 300 Index are on track to drop 10% or more this year, one of the broadest sell-offs since the global financial crisis.

There’s been nowhere to hide in a market already under pressure from slowing economic growth, record corporate defaults and China’s souring relationship with the US on trade.

Below is a look at everything that’s gone wrong for yuan-denominated shares this year, the first time they’ve featured on global equity benchmarks. The CSI 300 lost 1.7% on Friday, erasing its weekly gain.

Telecoms: Some of China’s most downtrodden stocks are those of companies that make hardware. Allegations that ZTE Corp and Huawei Technologies Co violated US sanctions on Iran have led to bans and arrests and caused a whole lot of diplomatic strain between the world’s two largest economies.

The pain inflicted on ZTE, which was suspended for two months, was the first clue of how bad things would be this year.

Tech: Nowhere in the equity market were the ripples of the trade war more evident than in China’s technology sector. Their vast and global supply chain meant that companies like GoerTek, down 59% this year, are considering whether to shift their production out of China in order to continuing doing business.

The Trump administration’s plans to tighten restrictions on exports due to national security concerns have weighed on surveillance stocks, most notably Hangzhou Hikvision Digital Technology Company.

Consumer: China’s consumers were supposed to be isolated from the trade war fallout. But escalating tensions hit confidence just as a collapse in peer-to-peer lending platforms wiped out some individuals’ finances.

Consumers tightened their purses and looked for bargains: sales of cars, and washing machines all disappointed at some point in the year. Making matters worse is intensifying competition, further squeezing profitability. A gauge of consumer discretionary stocks has lost 34% since its January high.

Drugs: Another slam-dunk trade gone awry: pharma. Defensive and exposed to the growing medical needs of China’s ageing population, the stocks were loved by investors as recently as June. That all began unravelling after public anger erupted over a vaccine scandal that quickly contaminated the stocks of other companies.

After a brief period of stabilisation, a fresh wave of selling came this month amid panic that the government is driving down generic drug prices through a new procurement programme.

Education: Beijing was also behind a global sell-off in Chinese education companies, a sector which is still so new to public markets that it had only just grabbed investors’ attention. China in November blindsided everyone with a set of new rules prohibiting those companies from financing for-profit kindergartens via the stock market.

Vtron Group Co is down almost 60% for the year, and newly listed peers in Hong Kong also got slapped. The concern is that tighter regulation will put a ceiling on the high pace of growth that investors were counting on for the country’s nascent private education industry.

China