South Korea’s peer-to-peer lending market is tiny compared with China’s but authorities in Seoul are seeking to avoid the mishaps now forcing Chinese regulators to crack down on the industry.

Korea’s Financial Services Commission will adopt new regulations from January 1 to increase disclosure by online operators amid a surge in so-called P2P lending.

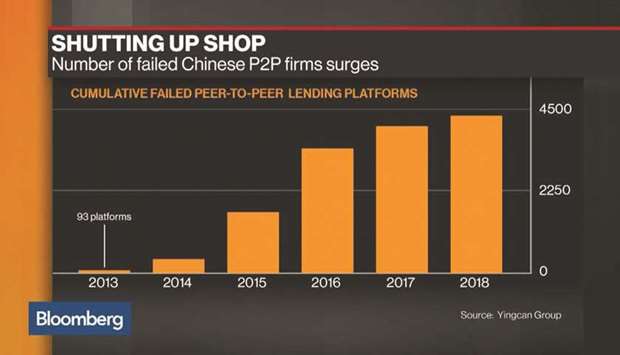

A financial watchdog said last month it asked prosecutors and police to investigate 20 platforms suspected of embezzlement and fraud. China is reining in its $176bn experiment with P2P lending after the market spawned the nation’s biggest Ponzi scheme and protests in major cities.

In South Korea, the market is still relatively small at about $5bn but it’s grown dramatically since 2015 when there were virtually no such loans.

The total number of P2P firms has surged to 205 from only 27 during the same period.

Korean authorities want to harness the potential of P2P lending, which enables individuals to borrow and lend money without a financial institution.

It could help some borrowers who face difficulty in accessing traditional bank loans, and as the nation’s economic expansion sputters.

“Although there are some negative aspects, we recognise the positive role of P2P lending in making up for what existing financial institutions cannot do,” said Song Hyun-do, director of financial innovation at Korea’s FSC. “The aim is to secure sound development of the industry.”

Peer-to-peer lending has had a rocky start in a number of jurisdictions. US-based LendingClub Corp, battered by a corporate governance scandal and investor withdrawals, saw its stock tumble from a high of $29.29 to as low as $2.57.

A popular Chinese P2P platform unravelled in 2016, in what authorities described as a $7.6bn Ponzi scheme that defrauded 900,000 people.

South Korea has also had its share of shady operators and the FSC said this week it will revise disclosure guidelines, especially for products related to real estate, which accounted for 65.1% of the total P2P lending as of end-May.

Borrowers with mid-credit scores – typical candidates for P2P lending – accounted for about 31% of the total 26.5mn debtors in Korea as of June.

Such borrowers often find it hard to obtain bank loans, most of which have interest rates less than 5%, and end up paying much higher charges for funds.

Almost all loans by private lending firms had interest of 20% or more, according to data from Lee Tae-kyu, a lawmaker with the opposition Bareunmirae Party.

The average rate for P2P loans is in the range of 12% to 16%, FSC data show.

Graph 3