The US International Trade Commission has just slapped anti-dumping duties on imports of Chinese common aluminium alloy sheet.

It’s another brick in the trade wall being erected by the Trump administration as it seeks to insulate domestic manufacturers from the flood of what it deems unfairly subsidised Chinese products.

US imports of Chinese alloy sheet surged by 731% between 2007 and 2017, with Chinese product accounting for nearly 40% of total imports last year, according to the US Aluminum Association.

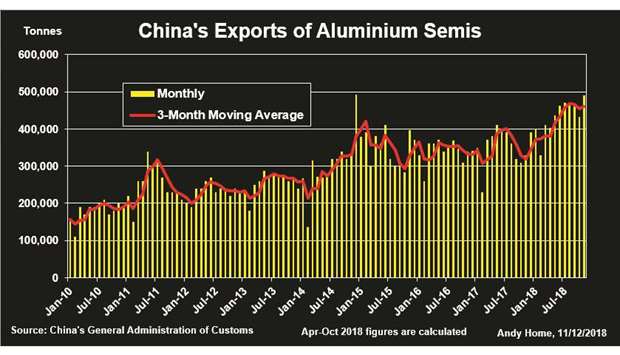

The latest action builds on similar penal duties imposed on imports of Chinese foil and the broader “Section 232” tariffs on all imports of aluminium and steel. However, China’s exports of aluminium products are still accelerating, with outbound flows on track to set a new record this year.

Quite evidently, what the rest of the world regards as the core problem facing the aluminium sector has so far not been touched by US trade measures.

Indeed, the tariffs wall may itself be leaking, with the Aluminum Association concerned about how the Department of Commerce is dealing with the multiple requests for exclusions.

China’s exports of aluminium in all forms grew by 21% to 5.3mn tonnes in the first 11 months of this year.

This is the headline figure included in the preliminary snapshot released by China’s customs department and comprises primary metal, aluminium alloy and semi-manufactured products. Since March, when the customs department changed how it publishes the country’s commodities trade figures, there has been no regular detailed breakdown of that outbound flow.

But thanks to the department’s new website, a clearer picture can be drawn. Exports of primary metal remain negligible, coming in at under 30,000 tonnes in January-October. Exports of unwrought alloy were larger over the same period at around 410,000 tonnes, but were down 10% on year-earlier levels.

Stripping those two types of metal out of the headline figure reveals that exports of semi-manufactured products (“semis”) totalled 4.3mn tonnes in the first 10 months of this year.

That’s already more than the whole of 2017, itself a record year for Chinese exports. Although Chinese production of aluminium has shown signs of slowing this year under the combined weight of environmental crackdown and margin pressure, the country still accounted for 56% of global output in October.

Moreover, Beijing has tweaked its tax rules to facilitate more exports of aluminium semis. A value-added tax (VAT) rebate on such exports has been raised from 13 to 16%. Since Chinese VAT stands at 17%, this amounts to a tax-free export pass.

The move, intended to cushion exporters against US tariffs, has not only stimulated exports of genuine product but also of “fake semis”, according to industry consultancy CRU.

Such metal, minimally transformed to exploit China’s export tax differentials, has been showing up in other Asian countries and could build to 800,000 tonnes next year, according to CRU senior analyst Greg Wittbecker.

It is the very nature of unilateral trade sanctions that US actions on aluminium mean trouble for other countries as the global supply chain readjusts. But it’s far from clear that the US tariffs wall is even doing what it is supposed to do, namely reduce the flow of Chinese material into the domestic market.

The Aluminum Association, which represents over a hundred companies in the US aluminium sector, wrote an open letter to the Department of Commerce on November 13 to express its concern about how requests to be excluded from the “Section 232” import tariffs are being handled.

Exclusions from the 10-percent import duty are granted if the petitioning company can prove it cannot source equivalent products in the domestic market.

The Commerce Department has been inundated with thousands of such requests from US aluminium and steel users and, according to the Aluminum Association, is not processing them as strictly as it should. Take as an example precisely the sort of common alloy sheet which has just had countervailing duties imposed.

The Association claims that Commerce has granted 360 exclusions for this form of aluminium, including 306 which include products from China, with more than 1,000 requests pending. It draws attention to two “especially notable” exclusions.

Ta Chen International, a major US distributor of metal products, has got an exclusion for 890,000 tonnes of common alloy sheet and plate, more than half of it coming from China. Mandel Metals, a specialist aluminium distributor, has been granted exclusions covering 270,000 tonnes of product.

Between them these two exclusions alone represent a significant part of the US market for such products, according to the Association.

“Generally, it seems the Department is not evaluating whether there is actually demand in the market for these large volumes and has granted the requests based simply on the absence of any objections,” said Heidi Brock, president and chief executive of the Association.

Andy Home is a columnist for Reuters. The views expressed are those of the author.

Graph