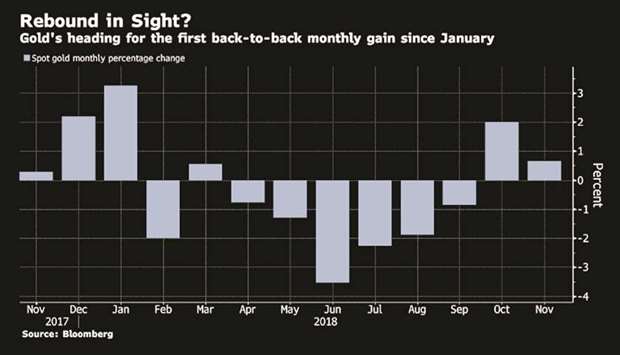

Gold may be turning the corner as prices head for the first back-to-back monthly gain since January, holdings in exchange-traded funds expand and investors reappraise the metal’s prospects in 2019.

The shifts have come as Federal Reserve Chairman Jerome Powell’s comments this week reinforced the sense the central bank may be approaching a hiatus in raising borrowing costs, saying rates are “just below” estimates of the so-called neutral level. Minutes on Thursday from its last meeting signalled policymakers will adopt a more flexible approach after a likely December hike.

Gold has begun to claw its way back since hitting a 19- month low in August, and Goldman Sachs Group Inc is among banks talking up the outlook, listing the metal among top picks for 2019 as the strong-dollar trend is seen reversing. Near term, with gold’s fate tied to the greenback, all eyes will be on meeting between US President Donald Trump and Chinese leader Xi Jinping at the Group of 20 summit in Argentina. A deal on trade could hit the dollar, potentially aiding the precious metal even as global tensions ease.

“While we remain of the view that price risk is still skewed to the upside through year-end, we think there is more potential going into 2019,” RBC Capital Markets said in a note. “On top of seasonal strength at the start of 2019, we think the market will warm back up to gold through the year as a place to park a sizeable allocation.”

Spot gold was 0.1% lower at $1,222.80 an ounce in London, up 0.7% this month after a 2% rise in October. Investors boosted holdings in exchange-traded funds by more than 40 tons over the two months. A gauge of the dollar fell in November, while 10-year Treasury yields are at the lowest since September.

Gold remains “at the mercy” of the dollar, Berenberg analyst Sanam Nourbakhs said in a note. While it’s difficult to forecast “rapidly accelerating gold prices at a time of strong US economic performance and increasingly short speculative positions,” gold seems well supported in the $1,190 to $1,230 per ounce range for now, he said.

Prospects for higher bullion prices have boosted shares of leading mining companies. An index of 15 producers tracked by Bloomberg Intelligence is up for the second straight month, with Goldcorp Inc and Kinross Gold Corp among the top performers in November.

Palladium surged to a fresh record of $1,199.18 an ounce on Friday, within a hair’s distance of breaching the $1,200 level. The metal, which is used to reduce pollution in gasoline engines, has gained 11% in November. It’s a different story for sister metal platinum, which fell for a fourth day. Platinum’s 14-day relative strength index has declined to 33, closing in on the level of 30 that suggests to some chart watchers a security is over-sold.

Gold