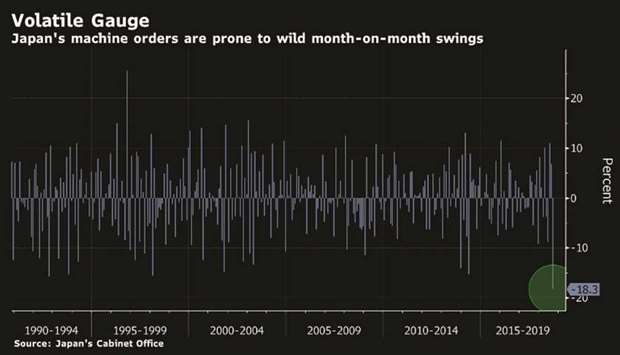

Japan’s core machinery orders tumbled by the most on record in September after a severe earthquake and typhoons disrupted business activity, with economists now also worried about a fall in overseas orders.

The 18.3% slump in machinery orders far outpaced the median market estimate for a 10% decline and follows a 6.8% increase in August.

September’s 12.5% decline in overseas machinery orders, the biggest such fall in more than two years, could signal sustained weakness in export demand.

Japan’s economy is forecast to contract in July-September, and the machinery orders slump suggests any rebound in the following quarters is likely to be weak if exports and business investment lose momentum.

Manufacturers surveyed by the government expect core machinery orders to rise 3.6% in October-December after a 0.9% increase in July-September, but some economists worry this forecast is overly optimistic. “I was already expecting capital expenditure to be weak in July-September, but the fall in overseas orders makes me worried about demand from China,” said Hiroaki Muto, economist at Tokai Tokyo Research Center. “Japan’s economy will resume expansion from the fourth quarter, but I’m worried the pace of growth will wane.” Orders from manufacturers fell 17.3% in September after a 6.6% in August, due to declining demand from makers of chemicals, electronics and vehicles, the data showed.

Service-sector orders fell 17.1%, versus a 6% increase in the previous month, due to a decline in orders for railway cars, heavy machinery, and computers. “Core” machinery orders exclude those for ships and from electricity utilities.

The government changed its assessment of machinery orders to say they are recovering but fell sharply in September.

The northern island of Hokkaido lost power after a severe earthquake in September, which followed a series of typhoons and floods that damaged infrastructure in western Japan, although many businesses quickly resumed operations.

Japan’s index of coincident economic indicators, which is calculated from industrial output, jobs and retail sales data, fell a preliminary 2.1 points in September, concurrent with the natural disasters.

The government cut its assessment of the coincident index for the first time since May 2015, saying it is stalling.

Economic growth data due on November 14 is expected to show Japan’s economy contracted an annualised 1% in July-September, a Reuters poll found, largely due to the natural disasters and slowdown in overseas demand.

Graph 2