Oman will increase its liquefied natural gas production capacity by 10% over the next four years, joining a wave of expansions to meet rising demand.

Capacity will be increased to 11.4mn metric tonnes a year by 2022, Harib al-Kitani, chief executive officer of Oman Liquefied Natural Gas, said yesterday in an interview in Muscat. The expansion will be achieved by “debottlenecking” existing plants, he said.

Global LNG demand is expected to rise by more than a third over the next decade to 416mn tonnes a year, according to Bloomberg NEF. Driven by rising Chinese imports and new destinations like Vietnam and Pakistan, gas producers from Qatar, Australia, Africa and the US are boosting output to capture a bigger share of the market.

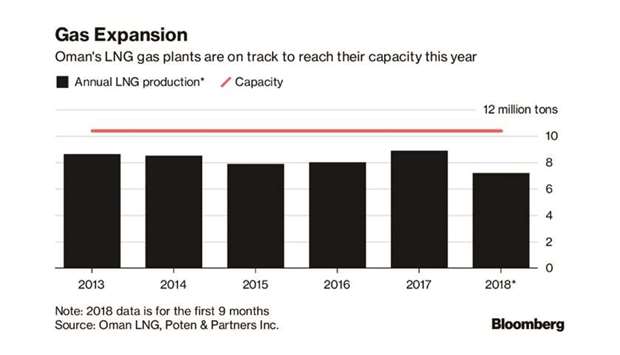

Oman hasn’t used more than 85% of its annual 10.4-mn-tonne LNG capacity over the past five years, according to Oman LNG, which operates the country’s three plants that liquefy gas for export. Production fell to 75% of capacity in some years as domestic natural gas demand for power generation and industrial uses surged, al-Kitani said.

New gas fields, some which use the same technology that unlocked shale deposits in the US, have boosted supplies, allowing Oman to operate its LNG plants at full capacity this year and plan for expansion. Oman shipped 7.2mn tonnes of LNG during the first nine months of 2018, according to al-Katani. LNG for delivery in December using the Japan/Korea Marker jumped to more than 17% of the price for Brent crude, the futures contract on which most deals are based. That compares with 14% for some legacy long-term agreements, according to data from Poten & Partners Inc shipbrokers.

Rising export volumes allowed Oman LNG to sell spot cargoes and benefit from higher LNG prices this year, al-Kitani said. The gains still won’t bring the company back to its profitability when oil was over $100 a barrel, he said.

Oman LNG’s net income dropped to $642mn in 2017 from $1.8bn in 2014, while revenue slumped to $2.2bn from $4.1bn over the same period, according to its annual report.

Oman’s gas fortunes have changed, shifting from considering imports in 2015 to now boosting exports. The bounty from Oman’s onshore Khazzan gas field, operated by BP, spurred new potential partnerships between Oman’s government and Royal Dutch Shell for a gas-to-liquids plant and with Total to use LNG as fuel for ships. Oman LNG is also receiving proposals.

“Companies know the government is finding more gas and they are coming to us with more solutions and pitching us on how to sell the gas,” al-Kitani said. Ideas presented include building floating liquefaction facilities, he said.

Graph 4