Oil prices headed for a second weekly decline on swelling US inventories and concern that trade wars were curbing economic activity. Although seeing a small rise on Friday due to signs of surging demand in China, the world’s No 2 oil consumer, prices were down for a consecutive week. Refinery throughput in China, rose in September to a record 12.49mn barrels per day (bpd) according to government data. The data fed hopes about oil demand in China, even though economic growth slowed in the third quarter to its weakest since the global financial crisis. The market has also been focused on US sanctions on Iran, which will take effect on November 4 and are designed to cut crude exports from the country.

US government data also pressured prices this week, showing crude inventories rising to 6.5mn barrels, a fourth straight weekly build and almost triple the amount analysts had forecast. Rising supplies, particularly at Cushing, Oklahoma, the delivery hub for WTI, pushed the market into contango, in which nearby prices trade lower than forward prices. This happened on Thursday for the first time since May 22. The US oil drilling rig count rose by four to 873 during the week, the highest since March 2015.

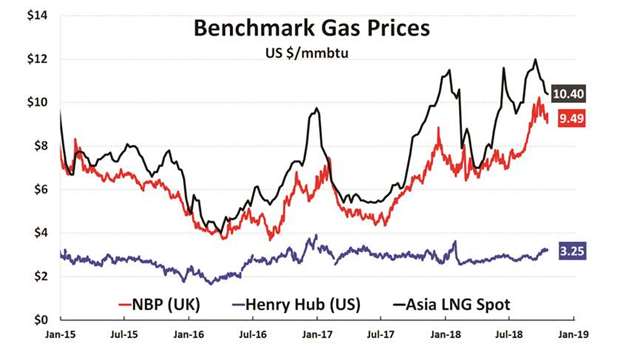

Gas

Asian spot prices for LNG dropped for a fourth week in a row, trading at their lowest in two months, amid increased supply courtesy of a new project in Australia and expectations of more from the US. As oil prices drop, LNG prices reined in as many contracts are oil-linked. In Asia, Japan’s Inpex offered four spot cargoes over the second half of October through November from its giant Ichthys project in north-western Australia, in a sign that it may be ramping up production.

Angola LNG and Sakhalin LNG each offered a cargo for November though details of the buyers were not immediately known. Australia’s Woodside Petroleum has also resold some of its US term cargoes. Woodside has an agreement to buy LNG from Cheniere’s planned Corpus Christi export plant on the US Gulf Coast. Chinese buyers were still largely absent from the spot market as they look towards longer term supplies ahead of winter. Unipec Asia, the trading arm of Chinese oil major Sinopec, is in talks to buy more LNG from the Exxon Mobil Corp-operated Papua New Guinea project, possibly for a period of 3 years.

n This article was supplied by the Abdullah bin Hamad Al-Attiyah International Foundation for Energy and Sustainable Development.