Pound traders can’t catch a break. Domestic politics is set to come back into focus for markets as the UK fights over how to break the deadlock in Brexit talks.

With the European Union proposing an extension to the transition period following Britain’s March exit from the bloc, Prime Minister Theresa May faces opposition to that prospect from her own party.

Given reports that her rivals are manoeuvring against her, the pound could be vulnerable to headlines.

“Theresa May has actually managed to unify the Conservative Party, unfortunately it’s in opposition to her plans,” said Jeremy Stretch, head of Group-of-10 currency strategy at Canadian Imperial Bank of Commerce, in an interview with Bloomberg Television. “It’s going to be a scenario where there is inherent political risk, accordingly that’s probably going to keep sterling on the defensive.”

With little on the data front this week, politics will again set the tone. Yet Brexit fatigue is setting in for markets, especially after the lack of progress from an EU summit last Wednesday that was meant to mark a key step forward. Pro-Brexit lawmakers have rallied against any extension of the transition, as they don’t want the UK to stay tied to the bloc’s rules. May has faced the threat of a leadership challenge before, and she lacks a parliamentary majority. However, pro- Brexit rebels acknowledge they don’t have the numbers to oust her. Until something definitive happens around Brexit or May’s leadership, the pound may just tread water, analysts said. Although the currency weakened around 1% versus the dollar last week, some of that was down to dollar strength, and it was little changed versus the euro for the second week.

“We can only expect larger moves in sterling if we really get an end of the negotiations, and I mean really the end, which is either a signed deal or not,” said Thu Lan Nguyen, a currency strategist at Commerzbank AG. “Even with some kind of agreement on the domestic policy level, the UK government then still needs to reach an agreement with the EU27.”

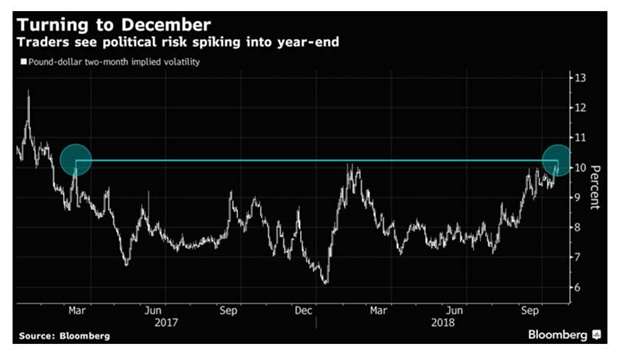

Another reason for smaller moves is positioning. The market is already heavily short the pound, and many investors are opting to bet through options rather than which way the pound goes.

Image 2