Paul Allen’s death may result in two major professional sports franchises being offered for sale at the same time, resulting in a “highly unusual” situation that may draw interest from a bevy of billionaires, according to sports bankers and lawyers.

Allen, who co-founded Microsoft Corp and amassed a net worth of $26.1bn, died on Monday from complications of non-Hodgkin’s lymphoma, according to a statement from his investment firm Vulcan Inc. His assets include the National Football League’s Seattle Seahawks, which according to Forbes are worth $2.58bn, and the National Basketball Association’s Portland Trail Blazers, which are worth $1.3bn. He also owned a piece of Major League Soccer’s Seattle Sounders.

Bankers and lawyers who specialise in sports said they expect the franchises to be sold with the proceeds going to Allen’s philanthropic endeavours. Allen wasn’t married and didn’t have children, and his sister didn’t play an active role with either of the clubs.

While Allen’s estate hasn’t said what it intends to do with the teams, bankers and at least one prospective buyer are already speculating. The NFL is the richest and most-watched US sports league, while the NBA is widely considered to be the most global. Allen, who was 65, was the world’s 27th richest person on the Bloomberg billionaire’s Index. Vulcan, formed in 1986 as the chief investment vehicle for his life after Microsoft, became one of the most prominent family offices globally thanks to its high-profile bets on real estate and space. The billionaire, who signed the Giving Pledge in 2010, said he planned to dedicate the majority of his fortune to philanthropic endeavours including wildlife conservation and brain-cancer research.

A rabid sports fan, Allen bought the Trail Blazers in 1988 for about $70mn. He added the Seahawks in 1997 for about $194mn. The value of pro sports franchises has exploded since then, driven up by a seemingly insatiable global appetite for live content.

Allen’s source for his varied investments and sizeable charitable donations was his once-major stake in Redmond, Washington-based Microsoft. Allen, along with Gates, helped create an entire industry selling software for a new breed of smaller, more affordable and widely accessible computers.

“I am heartbroken by the passing of one of my oldest and dearest friends,” Gates said in a statement. “Paul was a true partner and dear friend. Personal computing would not have existed without him.”

Allen stepped down as an officer of the company in 1983 because he was grappling with Hodgkin’s lymphoma. In 2009, Allen was treated for non-Hodgkin’s lymphoma, which two weeks ago he said had returned.

Paul Gardner Allen was born on January 21, 1953, in Seattle to Kenneth and Faye Allen. His father was a university library executive and his mother was a teacher.

Allen went to the Lakeside School, where he met a younger Gates and the two worked on early computer programs in the school’s lab. In a time when computers were rare, Allen lurked in the University of Washington computer labs, using the machines and aiding students and professors. Finally a professor asked if he was actually a student and Allen was forced to admit he wasn’t. But he was allowed to stay, as long as he continued to be helpful, Allen said in a 2017 interview.

He attended Washington State University but didn’t graduate, dropping out and moving to Massachusetts to be closer to fellow computer aficionado Gates, who was attending Harvard University.

In 1975, they founded a company they called Micro-Soft in Albuquerque, New Mexico, after Allen saw a new Altair computer kit on the cover of Popular Electronics magazine and realised computer prices would drop and software would be necessary.

As they struggled to produce operating software for Altair and International Business Machines microcomputers, Allen was regarded as the brains of the partnership, while Gates was the marketing whiz, according to Laura Rich, author of The Accidental Zillionaire, an unauthorised biography of Allen.

Allen, a Microsoft general partner, initially held the title of vice president. When he left in 1983 for health reasons, he was executive vice president in charge of research and new product development. He remained on the board until 2000 and was a senior strategy adviser after that.

Vulcan, formed in 1986 as the chief investment vehicle for his life after Microsoft, became one of the most prominent family offices globally thanks to its high-profile bets on real estate and space. The billionaire, who signed the Giving Pledge in 2010, said he planned to dedicate the majority of his fortune to philanthropic endeavours including wildlife conservation and brain-cancer research.

“Paul wasn’t content with starting one company,” Gates said on Monday. “He channelled his intellect and compassion into a second act focused on improving people’s lives and strengthening communities in Seattle and around the world.”

Allen also assembled one of the world’s most celebrated art collections. A public exhibition of 28 pieces in 2006 showcased works by Pablo Picasso, Claude Monet and Roy Lichtenstein. His mega-yachts were a frequent sight at ports worldwide.

A rabid sports fan, Allen bought the Portland Trail Blazers, a National Basketball Association franchise, in 1988 for $70mn. That investment was a success — the team repeatedly made the NBA playoffs after his purchase, and by 2018 Forbes estimated the team was worth $1.3bn. In 1997, Allen bought the Seattle Seahawks, a National Football League team, and took a minority stake in a professional soccer team, the Seattle Sounders. He also bought The Sporting News.

Among more mainstream businesses, Allen acquired 80% of Ticketmaster Entertainment Inc in 1993 for $242mn and sold almost half of that company’s stock to Home Shopping Network for $209mn in HSN shares. He bought control of Charter Communications in 1998. Charter’s 2016 purchase and merger with Time Warner Cable made it the second-largest US cable company.

Allen also used his Microsoft fortune to fund scientific endeavours. He was the founder of the Allen Institute for Brain Science and the Institute for Cell Science. He also financed deep-sea exploration teams that located sunken World War II warships, such as the USS Indianapolis and USS Lexington.

Allen was the sole investor behind SpaceShipOne, a suborbital commercial spacecraft that climbed to an altitude of 377,591 feet in 2004, the first privately funded effort to put a civilian in suborbital space.

An avid Jimi Hendrix fan, Allen taught himself how to play the rock standard Purple Haze, winning praise from legendary music producer Quincy Jones for his talent, according to New York magazine. He also recorded a blues album with Chrissie Hynde, lead singer of the Pretenders, and used his Vulcan Productions unit to finance films, such as the series “The Blues.”

Allen wrote an autobiography, Idea Man: A Memoir by the Co-Founder of Microsoft, in 2011. In it, he recounted how Gates tried to buy out Allen’s minority stake in the company in 1983, offering $5 a share. Gates rejected Allen’s counteroffer of a $10 minimum. Allen said that was a lucky break for him because he would have lost billions in value by selling at that point.

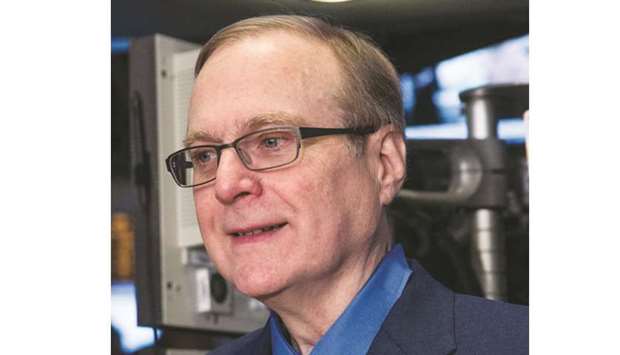

Allen: Industry pioneer.