Oil

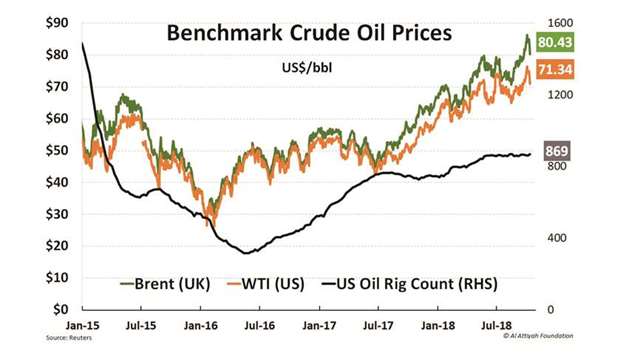

After four weeks of gains, benchmark crude futures declined last week by around 4%. Prices were dragged down by a significant increase in US crude inventories (+6mn barrels) and a sharp sell-off in US equity markets, while the IMF revised down its 2018 & 2019 economic growth forecasts to 3.7% (-0.2%). Prices also dropped as the market started to price in the different downside factors like the weaker oil demand outlook and the increase of production from different sources (Opec, Russia & US) since last May (+1.4 mbpd).

However, the price drop was limited by the continuous decline in Iranian crude supplies and the impact of Hurricane Michael who shut down part of US Gulf of Mexico oil and gas platforms for some days.

The International Energy Agency and Opec, in their last monthly oil market reports, agree that the oil market is currently well supplied. Whereas, both organisations revised down their outlook for oil demand next year by 1.36 mbpd, and the US Department of Energy expects US crude production to average 11 mbpd this quarter and 11.8 mbpd in 2019. This situation is expected to lead to more storage builds and potentially to a new oil market glut next year.

Gas

Asian spot LNG prices continued their slide for a fourth straight week, losing about 13% since mid-September. LNG prices were pressured as winter demand is taking time to pick-up while available supply is growing, amid a crude oil price weakness last week. Chinese winter demand which was expected to support the demand growth is yet to materialise, whereas Novatek’s Yamal LNG facility is expected to add a third train next December, and first LNG from Ichthys project in Australia, Sabine Pass fifth train and Corpus Christi first train is scheduled for the end of the year.

In the US, Henry Hub natural gas futures rose in the middle of last week to their highest level since late January — before losing some ground by the end of the week, making a modest weekly rise of less than 1%. Production loss from the Gulf of Mexico due to hurricane Michael and expected cold weather supported the prices. Meanwhile, UK gas futures declined significantly by 5% on a weekly basis, erasing the gain of the week earlier. Prices fell mainly due to a mild weather, a higher wind output and the recent weakness in crude prices. However, cold temperatures falling this week as low as 10 degrees Celsius are expected to support the gas demand.

n This article was supplied by the Abdullah bin Hamad Al-Attiyah International Foundation for Energy and Sustainable Development.

Weekly