Canada’s Barrick Gold has agreed to buy Randgold Resources Ltd in a $18.3bn share deal to create the world’s largest gold company in an industry under investor pressure to put capital to good use.

The new Barrick company, which will be listed in New York and Toronto, will own five of the world’s 10 lowest cost gold mines and will be valued at $24bn including debt.

The deal marks the biggest transaction in years in the gold mining industry, where companies have come under fire from investors for poorly managing capital, forcing them to focus on costs while dampening enthusiasm for acquisitions.

“Randgold has the agility and swift-footedness of a younger and smaller company, much like Barrick in its early years, while Barrick has the infrastructure and global reach of a large corporate company,” Barrick Chairman John Thornton said in a conference call. Randgold’s long-term boss Mark Bristow will become the chief executive and president of the merged company, taking chief financial officer Graham Shuttleworth with him and Barrick’s Thornton, an ex-Goldman Sachs banker, will be executive chairman.

Two-thirds of the directors of the board of the new Barrick will be nominated by Barrick and one-third by Randgold.

Randgold shares were up 5.7% at 1400 GMT, making it the biggest gainer in London’s wider mining index while shares of Barrick, the world’s second largest gold producer, were up over 6%.

“What the deal delivers Randgold shareholders...is more options in terms of growth and development, whereas before they only had one growth option of scale in Massawa,” said Investec analyst Hunter Hillcoat, referring to the miner’s gold project in Senegal.

The merger values Randgold at £4.58bn ($6bn), at £48.5-a-share and is equal to Randgold’s market capitalisation as of Friday’s close.

This lack of a premium for Randgold shareholders prompted scepticism from some analysts who were also concerned that Randgold’s agility could be bogged down by the mammoth Barrick.

“UK shareholders are arguably being dealt a poor hand with the merger,” said Russ Mould, investment director at AJ Bell.

“What Bristow has got to prove now is that bigger is better and the Randgold culture is the one that will perhaps prevail.”

Bristow, a 59-year old trained geologist, has been at the helm of Randgold since its inception in 1995 and is known for his straight-talking, hands-on approach to running the company.

The current spot gold price is not helping the sector, having lost out on traditional safe-haven flows to the dollar, pushing it 10% lower this year.

Both Barrick and Randgold have lost a third of their market capitalisations over the past year.

“We don’t see a reason to change Randgold’s approach... If we can’t deliver something that is bigger and better, then we wouldn’t do it,” Bristow said on a call with analysts.

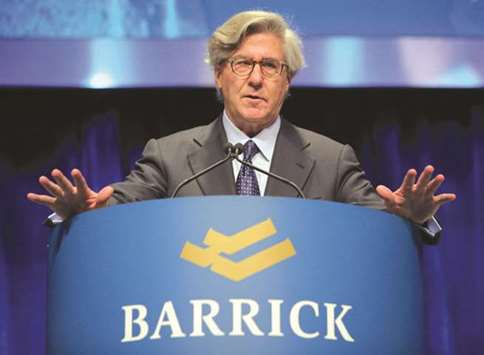

Barrick Gold executive chairman John Thornton attends the company’s annual shareholders meeting in Toronto, Ontario, Canada. Barrick Gold has agreed to buy Randgold Resources in a $18.3bn share deal to create the world’s largest gold company in an industry under investor pressure to put capital to good use.