Higher oil prices will allow for some positive multiplier effects on Qatar’s domestic demand and also support current account surpluses; QNB said and noted Qatar’s economic performance remains resilient.

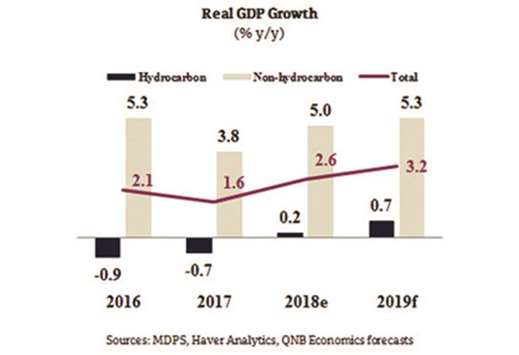

Despite the blockade by some of its neighbours, Qatar’s economy grew by 1.6% in 2017. Non-hydrocarbon GDP growth was a solid 3.8% in 2017, QNB said in an economic commentary yesterday.

For this year, the economy is on course for an overall growth of 2.6% and non-hydrocarbon growth of 5%. Activity is expected to accelerate further in 2019 with GDP growth of 3.2% and non-hydrocarbon growth of 5.3%, it said. GDP growth is forecast to gain by a solid 2.6% in 2018 as the drag from the hydrocarbon sector abates and the non-hydrocarbon sector is supported by construction, agriculture, manufacturing, transportation and storage.

Reflecting recent strength, QNB’s oil price forecasts are revised up to $72/b in 2018 and $69/b in 2019 (previously $69/b and $66/b). Strong global demand and various supply disruptions will keep prices firm well into 2019 before slowing global GDP growth and continued increases in US shale supply damp prices somewhat.

On the hydrocarbon side of Qatar’s real economy, a growth of 0.2% is anticipated, which would end four years of declines, QNB noted. The lifting of Opec production cuts should modestly boost crude oil production, while the end of maintenance work and temporary shutdowns should start to spur a recovery in LNG output through the year. A further pick up of 0.7% in hydrocarbon output is then expected in 2019.

Total non-hydrocarbon GDP growth was a robust 4.9% year-on-year (y-o-y) in Q1, 2018, starting the year on a strong footing.

Non-hydrocarbon GDP is expected to gain by 5% in 2018. For 2019 as a whole, QNB forecasts non-hydrocarbon GDP growth of 5.3%.

Accounting for 21% of non-hydrocarbon output, construction activity was up 17.5% in 2017, supported by key infrastructure projects related to Qatar’s Vision 2030 and also the 2022 World Cup. The construction sector’s buoyancy has continued so far in 2018 with the latest data showing output up 17.2% y-o-y in the first quarter.

Growth in the manufacturing sector, which accounts for a further 19.5% of non-hydrocarbon GDP, recovered to 1% in 2017 as projects aimed at greater self-sufficiency and food security start to take effect. Their impact can be seen more clearly in recent quarters with manufacturing output growth up 3% y-o-y in Q1, 2018. Government policies to promote private-sector development are also lifting domestic demand. Agriculture (8.2% growth), manufacturing (3.2% growth), transportation and storage (3% growth) are expected to be the key beneficiaries with growth in these sectors expected to pick up further in 2019.

Continued population growth, with mid-year population expected to hit a record 2.81mn in 2018 then rising further to 2.89mn in 2019, will also work to spur additional domestic demand. External finances will be robust. The current account surplus should approach 9% of GDP in 2018: an improvement of around 4% of GDP in 2017 before subsiding to around 7% of GDP in 2019 as oil prices slip. Import growth is expected to remain moderate.

Helped by higher hydrocarbon prices, government finances are expected to steadily improve with the budget seen in broad balance in 2018 before a larger surplus emerges in 2019. The introduction of VAT in 2019 will lift revenues and help diversify the tax base.

Reflecting deflation in rental prices and slower food inflation, overall CPI inflation is expected to remain damped until the anticipated introduction of VAT boosts inflation in 2019. QNB targets average CPI inflation of 0.5% in 2018, rising to 1.9% in 2019.

“Qatar’s banking system remains healthy with ample liquidity, high asset quality and strong capitalisation,” QNB said. Deposit of 6% and loan growth of 5% is expected this year, which should result in some further decline in the loan-to-deposit ratio.

From 2019 onwards, the decision to increase LNG output by 30% by 2024 will increasingly drive Qatar’s next development phase. The 30% increase will boost Qatar’s LNG capacity from 77mn tonnes currently to 100mn tonnes by 2024. This increase in capacity will require substantial investments both onshore and offshore including the construction of three new LNG trains to process the gas.