Take Tolaram Group, which runs a $500mn family office in Singapore. After hiring former Millennium and Goldman Sachs Group staffers to manage $100mn of its own cash, Tolaram plans to convert the portfolio into a hedge fund and accept outside money next year. It’s the first foray into asset management for a family that made its fortune in textiles, consumer goods, and other mostly non-financial businesses.

Not content to simply cut costs by managing their wealth in-house, an increasing number of ultra-rich clans want to turn their family offices into revenue generators by charging the merely well-off to invest alongside them. While sceptics say conflict-of-interest concerns and limited track records may deter outside investors, the trend underscores the growing sophistication of Asia’s family offices and could pose a threat to incumbent money managers in a region that’s minting millionaires at the fastest pace worldwide.

“What we’re doing, I am sure other families will do in similar ways,” Manish Tibrewal, the chief executive officer of Tolaram’s family office, said in an interview.

At least eight family and multi-family offices in Asia have recently started, or are planning to start, investment funds that accept outside money. They include AJ Capital, which is currently applying for a license to make its planned financial services-focused lending fund available to external investors by March, and Kamet Capital Partners, which is planning a fund with a capacity of S$250mn ($182mn) to invest in liquid assets. Golden Equator Capital, JM Enigma and Golden Horse Fund Management also have offerings in the works.

They’re breathing fresh life into an idea pioneered in the US and Europe. The family office founded in 1882 by oil magnate John D Rockefeller opened an asset-management and advisory business in 1979, while billionaire Michael Dell’s MSD Capital launched an entity offering select strategies to outside investors in 2009. Quilvest, started by the family of German businessman Otto Bemberg, opened up its private equity fund of funds in 2002.

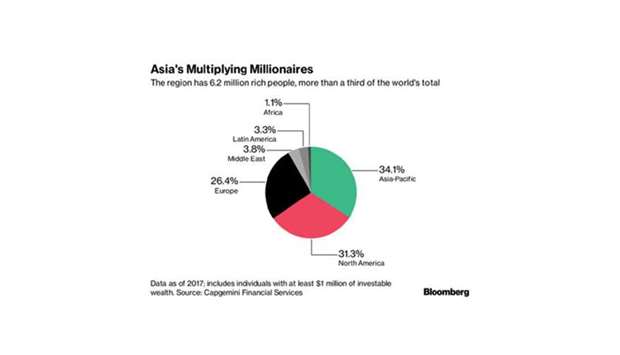

But Asia is now arguably the most important battleground for the world’s asset managers.

The region is home to more rich people than any other after adding new millionaires at an annual rate of about 12% last year, data compiled by Capgemini show. In 2016, a fresh Asia billionaire emerged every other day on average, according to the UBS/PwC billionaires Report.

Family offices have become an increasingly notable feature of the region’s wealth management scene. While each one is unique, they’re typically staffed by former investment bankers, hedge fund traders and private-equity analysts, overseeing investments that span both public and private markets. If managed well, they can give families more control over their assets and cost less than farming money out to hedge funds and private banks.

Family offices that take outside money see several advantages to opening up. For one, fee income helps offset the cost of hiring experienced investment professionals, which can quickly add up. At Tolaram, for example, the payroll now includes ex-Millennium trader Ankit Khandelwal, former Goldmanite Lee Kim Leng, and Liew Han Piow, who used to run the equity derivatives desk at United Overseas Bank. Other family offices in Asia have recently poached talent from firms including Deutsche Bank and GIC, Singapore’s sovereign wealth fund.

External investors can also help instil family offices with a greater sense of discipline and professionalism. That’s especially important when ageing founders begin passing the reins to younger generations.

It’s part of the “transition from family entrepreneur to entrepreneurial family,” said Thomas Zellweger, a professor of business administration at the University of St Gallen in Switzerland.

The challenge, of course, is convincing outsiders to hand over their cash. While family offices can tout their business acumen and show that they’ve got skin in the game, some observers question whether they’ll be able to compete with existing wealth-management offerings.

“I view this development with great scepticism,” said Claudia Zeisberger, a Singapore-based professor of entrepreneurship and family enterprise at Insead. “Asian family offices still have a way to go to achieve a level of institutionalisation that gives them the right governance structure, the right risk-management framework and the level of sophistication before they can start thinking about turning their family office into a business.”