When it comes to pollution, there’s a big, noxious cloud hanging over the shipping industry. By one estimate, a cruise liner belches out as much sulphur pollution as 380mn cars. To tackle the problem, maritime authorities are drastically tightening emission limits. But the new rules – due to kick in January 1, 2020 – are generating a degree of panic among shippers, as well as concern that oil consumers, from airlines to car owners, will face higher prices. Some refiners are rubbing their hands in anticipation.

1. Why the panic?

Shipping companies face two options to comply: Purchase more expensive, cleaner fuel or install pollution-reducing scrubbers that can handle oil with a higher sulphur content. But here’s the thing: Fitting a scrubber can cost as much as $6mn per ship. Fewer than 3% of the world’s 55,000 large vessels will have scrubbers by the end of 2020, according to IHS Markit. That means the vast majority will need to switch to using low-pollutant fuel. And here’s another thing: It’s not clear there’ll be enough clean fuel to go around.

2. What are the new rules?

Fuel must have a maximum sulphur content of 0.5%, down from the current 3.5% limit in most cases. Known as IMO 2020, the regulation is set by the International Maritime Organisation, a UN agency with responsibility for the safety and security of shipping as well as marine pollution by ships. Sulphur emissions are linked to acid rain and medical conditions such as asthma.

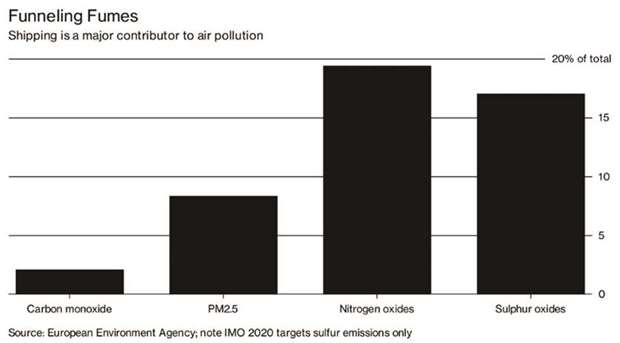

3. Why does shipping cause pollution?

Because ships use heavy fuel oil – the gunk that’s left over in the refining process once more valuable, less sulphurous products such as gasoline, diesel and jet fuel have been squeezed out of crude oil. Although IMO rules have progressively tightened sulphur limits since 2005, there’s a long way to go: A Finnish study in 2016 estimated that air pollution from ships under current guidelines would contribute to more than 570,000 premature deaths worldwide between 2020 and 2025.

4. Which fuel will shippers switch to?

While that’s still unclear, analysts expect increased demand for so-called middle distillates such as diesel, also known as marine gasoil. Maersk Oil Trading says that may be the “optimum route for compliance.” Some analysts see diesel’s price premium over high sulphur fuel in 2020 at $450 to $500 per ton. In October, it was just $250.

5. Why might there not be enough fuel?

Because not all refineries can turn dirty fuel into IMO-compliant products. Simpler plants will be left with a lot of unwanted heavy fuel oil: SEB forecasts global demand for such fuel will shrink to less than a tenth of current levels by 2020. JPMorgan Chase & Co says fuel oil profitability will collapse. By region, US refiners may benefit more since they have high-specification plants that produce lower amounts of heavy oil, while Europe will likely suffer without refinery upgrades, according to ING Groep NV. Refiners including Repsol SA, Phillips 66 and Hyundai Oilbank Co say they’re well-positioned to benefit.

6. Who else will suffer?

Potentially anyone who buys petroleum products – including airlines, trucking companies and automobile drivers. That’s because the extra demand for cleaner fuel from shippers will mean refiners may produce lower quantities of products such as jet fuel and gasoline. Consultant Energy Aspects forecasts a tighter gasoline market as refineries adjust to the changes. Some shippers contend that the new rules have the potential to upend world trade, since the cost of compliance will be too high for many. Delaying implementation is now out of the question, according to the IMO.

7. Will crude oil demand be affected?

Demand from refineries for so-called sweet (low sulphur) crude such as Brent will likely rise, at the expense of sour (high sulphur) crude produced mostly in the Middle East. Consultant FGE estimates that Brent’s premium to Middle Eastern benchmark Dubai oil could more than double to at least $8 a barrel.

8. So will there be enough fuel?

That depends who you ask. A 2016 study commissioned by refiners and shippers predicted there will be insufficient refining capacity to produce the fuels needed to comply with IMO 2020. On the other hand, an IMO-backed report concluded there’d be enough capacity. Groups including the International Energy Agency say they expect a bumpy ride, at least in the beginning. Consultant Rapidan Energy Group said US President Donald Trump’s concern over high oil prices represents an “under-appreciated risk” for the implementation of IMO 2020. Height Securities contends Trump is unlikely to intervene, since US refineries are set to benefit.

GULF TIMES