India’s financial capital Mumbai witnessed the biggest decline in residential property prices among major cities this year as the market struggled to emerge from a string of recent reforms that have hurt sentiment, according to Knight Frank.

Mumbai home prices fell 9% in the six months ended June after dropping for the first in a decade last year, while sales rose by 1% from a year earlier to 32,412 units, according to a report from the consultant.

Launches of residential projects climbed 128% in Mumbai, mainly due to the temporary lifting of a ban on new constructions within city limits that had been in place since March 2016.

“A lot of uncertainty still exists in the market,” said Knight Frank chairman and managing director Shishir Baijal, pointing to federal elections next year as well as rising inflation and interest rates. “It could perhaps still be a rocky way ahead for the real estate industry.”

The past two years have been packed with uncertainty and volatility for the property sector.

A crackdown on undeclared cash, new consumer protection measures and the roll-out of a nationwide sales tax led to the worst home-sales slump this decade in 2017.

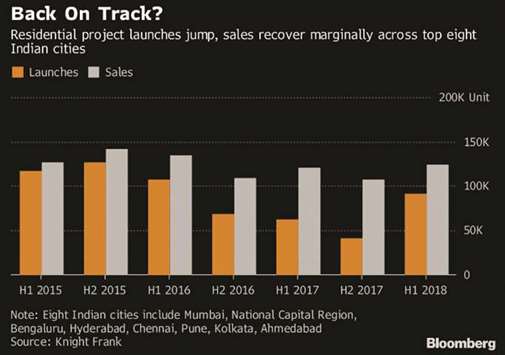

Residential sales across eight cities increased 3% in the first half of 2018 from a year ago, helped by “stellar growth” in technology centre Bengaluru, which saw a 22% increase; Kolkata witnessed the sharpest drop at 19%. Home launches jumped 46% in the first half, with supply concentrated at lower ticket sizes. Weighted average prices across eight cities declined 3%; though the effective price drop was of 10% to 15% across Mumbai, the National Capital Region, Pune and Kolkata once incentives were included. Unsold inventory across eight cities declined 17% from a year ago. The project life cycle, representing the time taken from launch to complete sale, across eight cities increased to 27.4 quarters from 24.4, which indicates it’s taking developers longer to exit a project. India’s office property market saw transactions covering 21.5mn square feet, registering a 13% growth; 18.2mn square feet of office space came online, yet supply crunch of quality office space continued.

Rentals grew 5% from a year ago, with all office markets experiencing healthy rental growth, led by Bengaluru; Mumbai was the only exception. “The long-awaited drop in prices is a healthy step toward market recovery as this, along with other measures such as reduction in unit sizes across cities, will boost home-buyer affordability and eventually get buyers back to the market,” according to the Knight Frank report.

.