Asia is steadily cementing its substantial role in the global Islamic finance industry, a new report by the Malaysia International Islamic Finance Center (MIFC) published in cooperation with Jeddah-based Islamic Corp for the Development of the Private Sector found. According to the research, entitled “Islamic finance in Asia: Reaching new heights,” Asia’s Islamic finance assets – excluding the Gulf Co-operation Council (GCC) – registered annual growth of 8.4% between 2011 and 2016 and stood at $528.7bn, or 26% of the world’s Shariah-compliant financial assets, at the end of 2017.

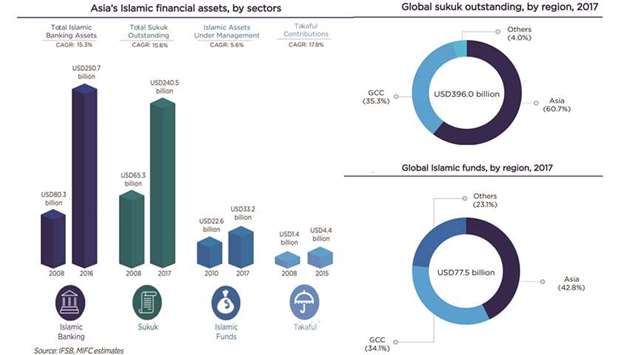

Furthermore, Asia has grown to the largest market for sukuk, after $52.3bn or 52.5% of all newly issued sukuk came from Asia in 2017, with most notable contributors being Hong Kong, Indonesia and Pakistan. The region also has a global market share of 60.7% of sukuk outstanding and is market leader in Islamic funds, with 42.8% of global Islamic assets under management at the end of last year, more than any other region.

The report states that Malaysia, Bangladesh, Brunei and Indonesia are currently among the most developed Islamic banking jurisdictions in Asia ex GCC.

Malaysia manages most of the Islamic banking assets in the region at a volume of $182.8bn, which results in a regional market share of 67.5%. Bangladesh stands second with $30.3bn, or 11.2%, ahead of Indonesia with $26.9bn, or 9.9%.

The significant growth momentum of Islamic finance in Asia is ascribed by the report to increasing demand from a growing Muslim population in the region – currently about 985mn people, or 60%, of the global Muslim population –, the expansion of Islamic finance to non-Muslim jurisdictions such as Japan and China, as well as to a number of initiatives by governments and regulatory bodies, spearheaded by Malaysia and to incentives in other countries such as Pakistan, which last year relaxed regulations for sukuk issuances by reducing issuance cost and easing regulatory burdens.

Indonesia, for its part, introduced a five-year roadmap for the Islamic banking industry that includes a new foreign-ownership policy for Islamic banks and promotes full-fledged takaful operations of insurance companies.

An important development was also the first-ever issuance of a green sukuk in July 2017 by Malaysia’s Tadau Energy and the subsequent launch of inaugurate Green Bond Standards in November last year by the 10-member Association of Southeast Asian Nations (Asean), with Malaysia being the first country to adopt them, followed by Indonesia in February 2018.

“The promising growth of the industry [in Asia] moving forward will be supported by its macroeconomic fundamentals, strong demographics, greater trade integration and economic reforms,” the report says in its outlook, estimating that the value of Islamic finance assets in the region will exceed $1tn by 2023. Another driver is the utilisation of Islamic finance in developing countries to address the basic needs of the society such as improved infrastructure, transport, telecommunication and sanitation, as well as the construction of hospitals, schools, universities and other public facilities by combining the economic potential and philanthropic objectives of Islamic finance.

According to the Asian Development Bank, Islamic finance instruments such as sukuk and other Islamic securities are ideally suited to fill the infrastructure financing gap in the region.

ill