While trade has been a core economic concept in the Muslim world for many centuries, Islamic trade finance has never played a big role in it. Risks related to international trade haven been taken on by Islamic banks as agents through straightforward risk provisions, or have been covered by conventional trade finance methods.

However, this situation is undergoing a chance process. Islamic trade finance has benefited from the significant rise in Shariah-compliant finance internationally and the boom of Islamic banking that came with it. It is increasingly understood that Islamic trade financing could serve as one of the key drivers to underpin further growth in the Islamic finance industry, which is expected to reach a volume of a whopping $3.8tn by 2022, according to a recent forecast by Thomson Reuters.

The main precondition for Islamic trade finance to increase its presence in Islamic finance is a closer co-operation between banks and businesses and a greater variety of financing products that better meet the needs of trade Corps, though. So far, Islamic trade financing has been carried out through simple solutions such as wakalah, a structure where a bank acts as an agent for traders and is paid fees and commissions, or letters of credit. With that alone, the impact of Islamic trade financing is limited and lacks competitiveness.

“There is a very clear role for convergence between the Islamic economy sectors, of which international trade is a critical component of growth, and Shariah-compliant trade finance solutions,” said Haroon Latif, director of Strategic Insights at Islamic economy research firm DinarStandard.

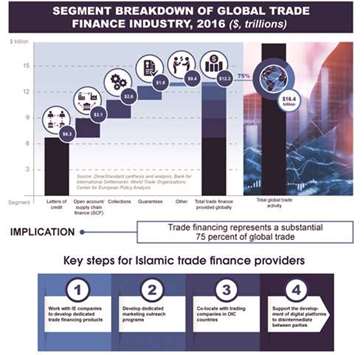

“There are numerous Shariah-compliant trade financing needs for Islamic economy companies, including import and export finance financing and refinancing, billing, factoring, provision of working capital and shipping guarantees, among others,” he added. The International Islamic Trade Finance Corp, one of the few organisations dealing with the sector set up in 2005 in Jeddah as part of the Islamic Development Bank Group, estimated the total trade volume covered by Islamic trade finance at just around $8bn in 2016.

Compared to the trade volume between the 57 member countries of the Organisation of Islamic Co-operation (OIC) alone of about $700bn in 2016, equivalent to around 20% of the OIC’s total trade volume (global imports and exports), the current volume covered by Islamic trade finance is just a mere 1.14% of intra-OIC trade, while experts say with the right instruments and closer co-operation between Islamic banks within the OIC the volume could easily reach 20%, or $140bn.

Experts say Islamic trade finance needs to be developed with instruments that allow better control of risks related to trade partners or countries, and credit risk could also be shared with another party through various types of trade instruments ranging from risk participation with a bank to using export credit agencies or multilateral credit agencies to provide credit risk mitigation.

In this context, Islamic trade finance could provide new opportunities and become the preferred choice for emerging markets such as Turkey, Indonesia, Malaysia, Qatar, Saudi Arabia and the UAE.

There have been efforts made by some Islamic banks in the Gulf to try expanding in Shariah-compliant trade finance through tieups with Western institutions. For example, Dubai Islamic Bank entered into a co-operation deal with Deutsche Bank to facilitate its Shariah-compliant letters of credit for trade with Europe, while Bank of America Merrill Lynch and Standard Chartered are also active in trade finance in the GCC region through partnerships. Barclays Bank just introduced Islamic trade finance in Kenya, by the way.

Meanwhile, the International Islamic Financial Market (IIFM), a standard-setting body on Islamic finance based in Bahrain, touched base with the Washington-based Bankers Association for Finance and Trade, a leading banking association for international business transactions, to create an industry standard for buying and selling Islamic trade-related risk in the form of a so-called master risk participation agreement to support Islamic trade finance. This potential new standard will be designed after the conventional master risk participation model, an industry benchmark for trade finance transactions over the past decade meeting all capital rules and other regulatory compliance requirements.

“We will incorporate the practical considerations for funded and unfunded risk participations in trade assets within a Shariah-compliant framework in this new standard,” said Khalid Hamad, chairman of IIFM, adding that this is expected to create “unified and transparent market practices and contribute to an increase of the trade finance business on a Shariah-compliant basis.”

Malaysia’s central bank is also pushing for Islamic trade financing to support 10% of the country’s total trade up to 2020. The bank is currently consulting the industry on a broad range of trade finance and connectivity initiatives, including the integration and digitisation of trade finance – which could also include blockchain-based trade finance solutions –, e-commerce and providing trade credit takaful to mitigate trade risks, according to Bank Negara Malaysia governor Muhammad bin Ibrahim.

.