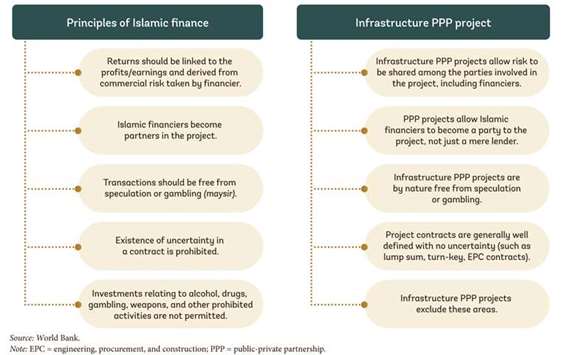

It is meanwhile commonly acknowledged that Islamic finance is a highly viable financing vehicle for large infrastructure projects, but this so far referred mainly to sukuk and other one-off, long-term financing instruments through sovereigns, public bodies such as infrastructure ministries or state-owned builders or utility firms. It is, as a matter of fact, far less understood as to how Islamic finance can fit within a public-private partnership (PPP) context and what the structural challenges and solutions are in such cases.

PPPs are long-term contractual agreements for the delivery of infrastructure or the provision of services related to infrastructure. Given the potential of Islamic finance to support infrastructure development in emerging and developing countries, it is critical to understand how Islamic finance can be applied in PPP infrastructure projects and what the building blocks of Islamic finance are in such a constellation.

This is even more important as PPPs are a commonly used scheme for smaller and more complex infrastructure projects to supplement larger public infrastructure roadmaps on various levels, encouraged by governments for their obvious advantages of bringing in third-party excellence, field expertise, know-how and management capabilities and also an agreed-upon amount of risk- and profit-sharing.

The point of bringing Islamic finance to the table of PPP-led infrastructure is of course to tap the vast volume of funds held by Muslim investors who are disapprobative of investing in conventionally-financed PPPs. Such financing also has significant liquidity.

The World Bank is a strong proponent of the use of Islamic finance within PPPs in order to close financing gaps particularly in developing Asia and Africa. And the demand is huge: According to estimations by US think tank Brookings Institution, the global economy will need to invest around $90tn in infrastructure from now up to 2030, of which Asia and Africa will need $1.7tn and $93bn annually, respectively, to fill their infrastructure gaps. In both regions, member countries of the Organization of Islamic Cooperation are among those with the highest investment demand, mainly for electricity generation and supply, transport networks and communication infrastructure. PPPs are generally regarded as better solutions for more urgent greenfield infrastructure projects, which is why there is a real benefit of deploying PPPs in support of the efficient and timely provision of overall infrastructure by a government.

“There is a natural fit in applying Islamic finance to infrastructure projects as it serves the very purpose of asset-backed redistribution of funds,” says Laurence W Carter, senior director infrastructure, PPPs and guarantees at the World Bank Group.

He points out that since global Islamic financial market has developed significantly and the regulatory and standard-setting institutions guiding Islamic finance practices were now well established, and the risk-sharing approach of Islamic finance is well understood, the readiness of PPP stakeholders to deploy Islamic finance has grown.

“It is now widely accepted that the hallmarks of Islamic finance structures with their asset-backed nature together with shared risks are wholly consistent with and can work well within infrastructure PPPs,” says Carter.

“Thus PPP projects are a natural fit for Islamic finance not by design, but rather by default, given the nature of these projects. In other words, PPP projects using conventional financing do not need any structural changes to accommodate Islamic finance,” he adds.

Adding to that, there are a large number of financing techniques suitable for Islamic finance-backed PPPs. Among those are Ijarah, or Islamic lease agreements; Murabahah, or sale and resale contracts; Istisna, a contract of exchange with deferred delivery; Musharakah, or risk partnership; and Mudarabah, a contractual arrangement under Islamic law between two partners for profit sharing whereby one provides capital and the other provides entrepreneurial or management skills.

Since insurance is an important tool for mitigating the risk of infrastructure PPP projects, takaful is also an obvious structure for PPPs, although not many insurance players are offering it in this context yet. Sukuk, on the other hand, are not the most suitable instruments for infrastructure PPP projects, because of the dynamic characteristic of greenfield projects which normally have an uneven pattern of capital expenditure and need injections of different amounts of funds at different times throughout their construction periods.

In case of a sukuk, the entire financing is raised on the first day of subscription which usually doesn’t correspond with the nature of a greenfield PPP, but there are of course exceptions.

Current notable case studies for Islamic finance-backed PPPs in the Muslim world are, among others, the Queen Alia International Airport in Jordan, the East Klang Valley expressway project in Malaysia, the Karachi-Thatta dual carriageway project in Pakistan, a container terminal project in Djibouti, a wind energy farm and other power projects in Pakistan, an integrated health campus in Konya, Turkey, and the Prince Mohammad Bin Abdulaziz International Airport in Saudi Arabia.

In order to raise awareness and build capacity for Islamic finance-funding PPs, the World Bank says it will look for more pilot projects to support and bring to the notice of potential investors, develop more Shariah-compliant financing structures, mobilise local Islamic funds and set up its own Shariah-compliant infrastructure funds for PPPs.

.