The spot price of rebar fell every day this week, losing 5.7% to 4,123 yuan a metric tonne on Friday, according to Antaike Information Development Co. The material has tumbled 18% since peaking at a multiyear high in early December. At the same time, stockpiles of rebar – which reached a nadir early last month – have started to rebound, rising for four straight weeks. China is the world’s top steel producer, and investors have been tracking policymakers’ efforts to curb supply in the north to cut pollution this winter. Even as that clampdown remains through to spring, mills are still making enough rebar for holdings to grow. Buyers were concerned prices had risen too fast and consumption has now dropped, China Merchants Futures Co said.

“Demand has fallen very quickly after December, with transaction volumes dropping,” Zhao Chaoyue, an analyst at China Merchants Futures, said in a text message on Friday. “Steel mills are still making good margins, so they’re unwilling to reduce production, leading to a rapid accumulation in stockpiles.”

Other steel product prices have also been in retreat. The spot price of hot-rolled sheet was at 4,145 yuan a tonne on Friday, down from 4,403 yuan in December, while cold-rolled sheet has fallen for the past four weeks, the longest run of declines since April.

As piles of rebar start to rebuild in China, port holdings of iron ore are also expanding, hitting another record this week. The stockpiles gained 1.3% to 152.8mn tonnes, Steelhome data showed on Friday. That’s the 13th straight week that the total has expanded.

The rising inventory of ore signals the pace of restocking by mills has slowed, posing a risk to the rally that’s pushed prices to almost $80, according to Nanhua Futures Co. On Friday, spot ore of 62% content fell to $78.05 a dry tonne, down from the highest since August, Metal Bulletin Ltd figures showed.

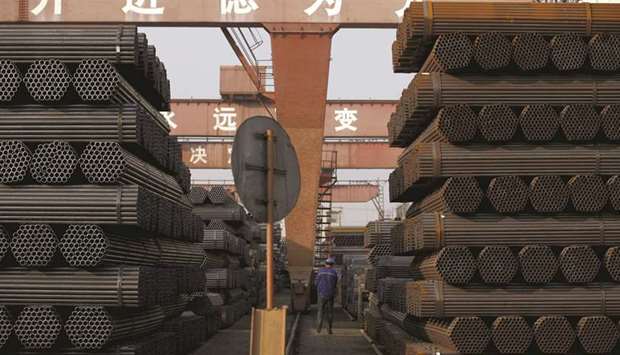

A worker walks past a pile of steel pipes at the yard of Youfa plant in Tangshan in China’s Hebei province. Steel prices in China are coming back down to earth, fast.

Reinforcement bar, a benchmark product that’s used in construction, sank to the

lowest level since August after a five-week retreat as demand eases, mills go on

pushing out supplies and nationwide stockpiles expand.