Hedge fund managers have started to take profits from the big rise in crude oil and refined products prices since June now the rally has lost momentum and inventories are showing signs of stabilising.

Portfolio managers cut their combined net long position in the five major futures and options contracts linked to petroleum prices by the equivalent of 34mn barrels in the week to December 5.

Net long positions were reduced to 1,120mn barrels, from the previous week’s record of 1,155mn, according to an analysis of position data published by regulators and exchanges.

The biggest reductions in bullish positions came in US heating oil and gasoline, where positions had reached record levels in recent weeks.

Net long positions in heating oil fell by 13mn barrels to 61mn barrels, from a record 75mn the previous week.

Long positions were cut by 9mn barrels while short positions were boosted by 4mn barrels.

Net long positions in gasoline fell by 8mn barrels, having declined by 3mn barrels and 7mn in the two previous weeks, and were down to just 107mn barrels on December 5 from a record 125mn barrels on November 14. Profit-taking by the holders of bullish long positions rather than short-selling by hedge funds establishing fresh shorts accounted for most of the reduction in net length.

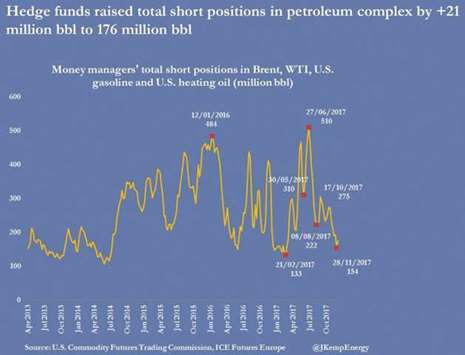

The same phenomenon was evident in European gasoil, which is not included in the analysis of the five major petroleum contracts. Net long positions in gasoil fell by more than 1.1mn tonnes to 14.7mn tonnes, with long positions down 0.9mn tonnes while short positions rose by 0.2mn tonnes. On the crude side, the pattern was different. Net long positions declined slightly in both Brent and WTI but the fall was caused by an increase in short positioning rather than profit-taking among the longs.

Gasoline and distillate stocks have stabilised in the past fortnight as a result of very heavy crude processing in the United States and elsewhere, which has dispelled some of the earlier concerns about falling inventories.

Gasoline and distillate prices led the rally in crude between June and the middle of November and now profit-taking on the products side has caused the crude rally to stall.

n John Kemp is a Reuters market analyst. The views expressed are his own.

.