The next segment of Islamic finance facing an upswing in volume and activity is the Islamic fund and wealth management sector, a report by Malaysia International Islamic Financial Center published earlier this year showed. As a result of the growing demand for Shariah-compliant investment options and the growing volume of investable Islamic financial assets, as per the end of the first quarter of 2017, total global Islamic assets under management (AuM) were $70.8bn, up from $47bn in 2008. The number of Islamic funds stood at 1,535, compared to 802 funds in 2008.

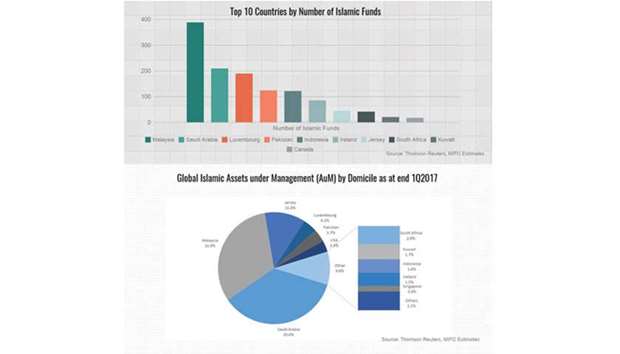

The report notes that Malaysia and Saudi Arabia have the largest market share of the global Islamic funds and wealth management industry, together holding more than 67% of total Shariah-compliant AuM. Saudi Arabia contributed a 35.6%-share of $25.2bn and 209 Islamic funds at end of the first quarter of 2017, while Malaysia has the most number of Islamic funds globally with 388 funds managing a total AuM of $22.6bn.

Interestingly, Jersey ranked third in the ranking with AuM of $8.35bn owing to funds domiciled in this jurisdiction largely comprising of high-volume commodity funds, including gold. Luxembourg, Pakistan, the US and South Africa followed with $2.9bn, $2.6bn, $2.3bn and $5.66bn of AuM, respectively. Kuwait, Indonesia, Ireland, Singapore, Canada, Egypt, Pakistan and the UAE are other notable players.

Most of the growth of the Islamic funds and wealth management industry stems from the fact that global fund and asset managers increasingly notice the potential of this sector of the Islamic finance industry. Since it is now also accessible to institutional investors, as well as non-Muslim investors – from affluent persons to high-net-worth individuals to family offices –, they began using it as a new way to diversify investments or to put surplus funds into “alternative” investment variants.

“The industry now forms as part of the emerging development in the wealth and management industry, a result of the growing interest from large and established fund managers tapping into this window of opportunities,” the report stated.

In terms of types of Islamic funds and invested assets, money market funds are leading as per AuM by 38,6%, followed by equity funds, commodity funds, bonds, real estate, mixed assets, and, to a very small extent of just 0.2%, alternative investments.

Consultancy PwC in a market report praised the Islamic fund and asset management industry as a “whole new world of investment,” noting that number of structural and behavioural changes are currently happening in Islamic countries, driving the growth of the sector which “will now go from strength to strength” as many asset management firms are currently “seizing up the opportunities.” Those opportunities are arising from the fact that – owing to the low oil price and the unclear future demand as the global energy sector is undergoing fundamental changes away from hydrocarbons –many affluent younger Muslims turned to the habit of saving for later life and with it, their investment preferences are expanding. Adding to that, with Gulf countries beginning to build up pension and healthcare funds for their citizens, they are expected to lift the Islamic funds industry to a higher level.

However, this investor base from the Gulf is just one of four large groups. Another is investors from Malaysia, which is a well-established and largely self-contained market in the Islamic funds industry. Another group encompasses Islamic countries or countries with large Islamic populations such as Indonesia, Pakistan, Bangladesh, Nigeria, Turkey and Egypt – where there is a significant, but largely untapped, potential market. After that, Europe, North America and Australia, with significant, relatively wealthy Muslim populations, are also promising markets for the industry.

“Opportunities for innovative asset management companies have rarely been better,” said Mutahar Abdallah, senior director at PwC’s branch in Riyadh, adding that there will be also a high demand for new tailored products for the sector. Those products could be introduced as enhanced and refined conventional asset classes to ensure they are fully Shariah-compliant, while investment vehicles such as fixed income funds need higher liquidity and adequate valuation to prosper. Other conventional assets classes, such as hedge and private equity funds, have to be scrutinised for their compliance to Islamic finance in the wake of developing new product offerings.

In a projection by Thomson Reuters, the global Islamic funds and asset management industry remains poised for growth and should increase in volume by more than 8% to $77bn by 2019.

.