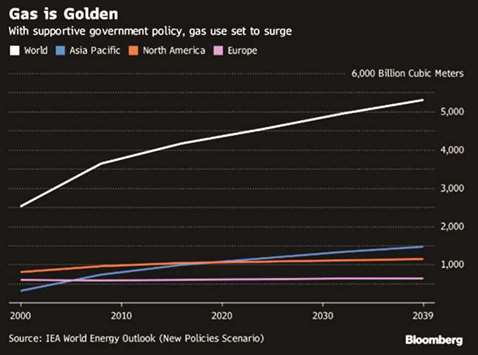

Natural gas is set to pull away from its more polluting siblings, oil and coal.

Demand for gas will jump about 45% through 2040, driven by industrial users in Asia, Africa, Latin America and the Middle East, the International Energy Agency said in its 2017 World Energy Outlook report. Usage at the end of the period is seen 1.6% higher than in last year’s report, according to the Paris-based adviser.

The prediction marks a return to optimism from the IEA, which asked in 2011 whether gas was entering a “golden age” as a bridge fuel for countries that couldn’t immediately bear the cost of swapping out carbon-heavy coal for renewables. But then the agency turned more bearish on demand as the plummeting cost of wind and solar raised questions about the necessity of a transition fuel.

Now thanks to gas-friendly policies in China that target pollution, among other factors, use of natural gas is projected to expand 1.6% a year on average in the outlook period. That compares with 0.5% a year growth for oil and 0.2% a year for coal. “If governments target local pollution, like we’ve experienced now in China, this would definitely slow the growth of coal and open the way for gas,” Fatih Birol, executive director of the IEA, said at a press conference in London. It’s mostly “all good news for natural gas.”

Still, the report warned of “potential pitfalls.” The US shale boom was not replicated outside of America, limiting a buildup of cheap supply that could have opened up additional demand.

Additionally, in countries such as India gas is only a small part of the energy mix, because switching can be expensive.

“If gas prices go up significantly, then there are two very strong competitors – coal and renewables,” Birol said. “The gas price trajectory is very important.”

What’s counteracted those setbacks, and kept gas on track to reach 25% of the world’s energy mix in 2040, a three percentage point gain, is industrial consumption. It accounts for more than 40% of additional gas use to 2025, while the power sector only accounts for 18% growth.

Much of this boost comes from the US, where a flood of cheap gas has displaced naphtha as a component of chemical production. Its use as a heating fuel gives gas a further edge with industrial users not wanting to convert everything to run on electricity.

The expansion of the liquefied natural gas trade has also helped. Qatar, currently the world’s largest exporter of LNG, earlier this year lifted a moratorium on production from the world’s largest gas field and said it will increase production capacity while the US and Russia are boosting exports. “Long-distance” gas trade will soar 75% by 2040, underpinned by the ample LNG supply, the report said.

“Our view is that the golden age of gas will continue,” Mel Ydreos, Toronto-based executive director of public affairs at the International Gas Union, said by telephone. “But we still have to ensure that governments and policy makers actually see it that way.”

.