US consumer confidence rose more than expected in October to the highest in almost 17 years as Americans grew more confident about the economy and job market, according to figures yesterday from the New York-based Conference Board.

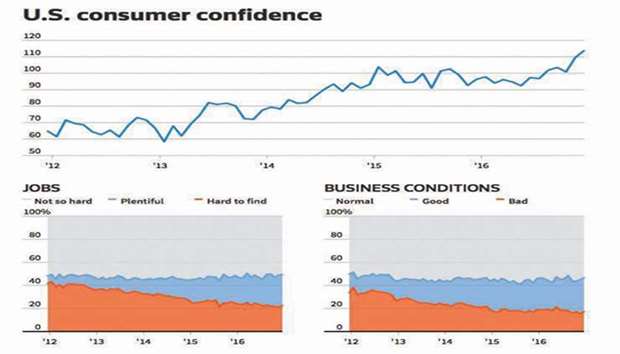

Confidence index rose to 125.9 (estimated 121.5), highest since December 2000, from 120.6 in September. Present conditions measure increased to 151.1, highest since 2001, from 146.9. Consumer expectations gauge rose to 109.1, a seven-month high, from 103.

Jumps in the Conference Board’s measures of the present situation and expectations signal Americans are becoming more upbeat about the economy and employment as the labour market improves and stock prices climb to records. Improvement in household confidence helps underpin their spending, the biggest part of the economy.

The results are consistent with other reports that showed economic activity and confidence are bouncing back, in part a sign that the hit from the recent hurricanes is dissipating. The University of Michigan’s consumer sentiment index climbed in October to the strongest since the start of 2004, while the Bloomberg Consumer Comfort Index is near the highest level of the expansion.

The share of respondents who say jobs are plentiful rose to 36.3%, the most since June 2001, while people reporting good business conditions increased to 34.5%, matching the highest since 2001.

“Confidence remains high among consumers, and their expectations suggest the economy will continue expanding at a solid pace for the remainder of the year,” Lynn Franco, director of economic indicators at the Conference Board, said in a statement.

Some 22.2% of consumers said they expect better business conditions in next six months, up from 20.9% in September. Share of households who expect incomes to rise in next six months was little changed at 20.3%, after 20.5%. Share of those who said more jobs will be available in coming months was 18.9%, after 19.2%. Buying plans showed a greater share anticipate the purchase of cars in the next six months, while fewer expect to buy homes and major appliances.