Emerging market currencies such as the Turkish lira and Chinese yuan were squeezed by a stronger dollar yesterday after reports that a policy hawk could be the next US Fed chair, while emerging stocks slipped off a six-year high.

The dollar firmed 0.2% against a basket of currencies to the strongest in a week and US 2-year Treasury yields jumped to their highest since 2008 after US President Donald Trump met Stanford University economist John Taylor to discuss the job of Federal Reserve Chair.

Taylor is known as a proponent of a rule-based monetary policy and according to his formula, the Fed funds rate needs to be much higher than the current target of 1.0-1.25%. A hawkish Fed could prompt investors to shift into US assets on the prospect of better yields, triggering capital outflows from emerging markets.

“Over the last three weeks, our official line has been stay away from dollar/EM as there is some uncertainty on the US fiscal and monetary front...and the market is wondering who next Fed chair will be,” said Kiran Kowshik, an emerging FX strategist at UniCredit. “Positioning in long EM FX is quite stretched.”

Emerging currencies such as the Turkish lira and Chinese yuan sold off the most, weakening some 0.4%. Kowshik said although the lira was undervalued, the external balance of payments was quite weak and there weren’t sufficient inflows to cover the current account deficit.

China’s yuan fell to a one-week low, slipping below a key threshold of 6.6 per dollar in the wake of a weaker official midpoint and higher corporate demand for dollars.

Investors remain cautious ahead of China’s twice-a-decade party congress starting today.

Other currencies traded flat or slightly lower, with the Mexican peso hovering near a five-month low hit on Monday.

The peso has shed about 4.5% this month, with Mexico’s finance minister blaming the depreciation on uncertainty around trade treaty renegotiations and questions over the pace of Fed tightening.

The Trump administration, which is demanding significant changes to the North American Free Trade Agreement (NAFTA), has presented a series of hard-line proposals that partners Canada and Mexico say will be tough to accept.

The Russian rouble held its ground, helped by higher oil prices.

In emerging Europe, currencies fared better, with the Czech crown hitting another four-year high against the euro whilst the Polish zloty was trading just off a three-month high ahead of wages and unemployment data.

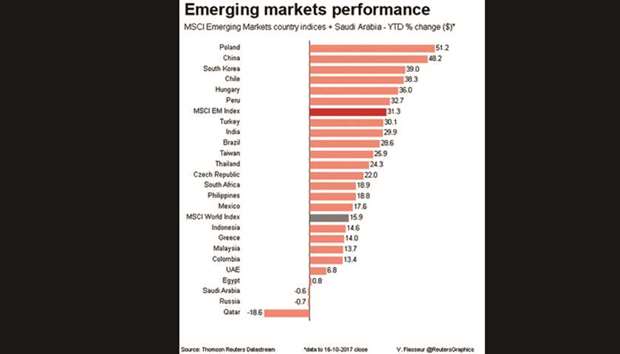

Emerging stocks slipped from six-year highs, with MSCI’s benchmark emerging equity index down 0.25%, ending a five-day winning streak.

Chinese mainland stocks fell 0.2%, Russian shares eased 0.4% and Hungary and Polish stocks nudged 0.3% lower.

But both the South Korean and Philippines bourses powered to record highs.

In the former, gains in large tech firms offset market caution about North Korean action as Washington and Seoul began week-long joint military drills.

Philippines stocks were playing catch up as trading resumed after a holiday.

In fixed income markets, Iraqi sovereign dollar bonds were steady.