Islamic bonds or sukuk investing in environmentally sustainable projects, renewable energy and climate change initiatives – so-called green sukuk – have become increasingly popular in the recent past as part of socially responsible or impact investment strategies of countries and companies alike.

In the latest development, Malaysia, the global frontrunner in Islamic finance, saw its first sukuk under a new sustainability framework issued in July 2017 when Malaysian solar power firm Tadau Energy came out with a green sukuk with a tenure of 16 years, raising 250mn ringgit ($59.2mn) from investors.

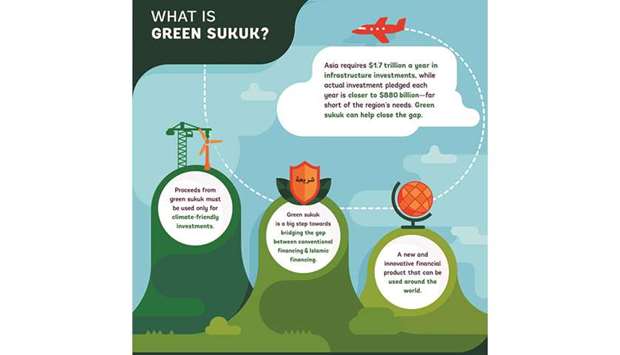

In a nutshell, green sukuk are built upon the characteristics of Shariah-compliant financing as a socially and ethically responsible financing instrument. This has raised interest in the international finance market as the method is seen as a perfect fit to fund larger and environmentally critical infrastructure projects. For example, proceeds from green sukuk can be used to finance and refinance construction debt, fund government-granted environment subsidies or support initiatives as part of the sustainable development goals drafted by the United Nations, as well as for impact investment strategies of private companies or asset managing firms.

Malaysia’s Securities Commission came up with a “Sustainable Responsible Investment Sukuk Framework” as early as in 2014, defining new requirements for the issuance of green sukuk. The new regulation clarified that proceeds of such sukuk should be used to preserve the environment and natural resources, conserve the use of energy, promote renewable technologies and reduce greenhouse gas emissions. The first sukuk issued under this regulation was the above mentioned solar power bond.

The World Bank lauded the “innovative approach” of Malaysia towards the financing of environmentally responsible projects. It said the opportunities were huge as they could include a large variety of projects, not just solar parks, but also biogas plants, wind energy and other energy efficiency projects, transmission of and infrastructure for renewable energy, electric vehicles and related infrastructure, light rail, green-compliant buildings and other property and could also be used for governments to fund green incentives such as subsidies and tax reliefs.

“We believe that there is a significant opportunity arising from strong global interest in green financing where innovative fundraising instruments like green and socially responsible sukuk are a viable solution to address global needs for green and other forms of sustainable and responsible financing,” said Ranjit Ajit Singh, chairman of Malaysia’s Securities Commission. This would also support Malaysia in achieving its goals of fighting climate change, a commitment arising from its signing of the 2016 Paris Agreement, he added.

Another initiative emerged in the Gulf Cooperation Council, where three institutions, Masdar City’s Clean Energy Business Council for Mena, the Climate Bonds Initiative and the Gulf Bond and Sukuk Association, set up the “Green Sukuk and Working Party” as a collaboration of experts in project development, environmental standards, capital markets, and Islamic finance. The group is now developing green sukuk for interested issuers, including governments, companies, financial firms and development banks.

Given the high demand for infrastructure projects in Asia, which also often have considerable environmental impact, the demand for green sukuk seems to be huge, particularly as the investor base can be extended beyond Muslim investors to the entire financial market by combining Islamic finance and sustainable or impact investment. Estimations are that between 25% and 40% of institutional investors’ assets under management are dedicated to fixed-income debt, including asset-backed securities on which Islamic finance is based. Another allure for sukuk is that their functional principle – the underlying assets, how the return is generated and how secure that return is – is easy to understand for the broader crowd of return-oriented investors.

The sukuk market is now predestined to channel the growing global Shariah-compliant capital pool to fund renewable energy and climate change projects, as well as other projects with socially meaningful impact.

Illustration: World Bank Group