China’s apparent natural gas consumption rose 11% y-o-y in H1, 2017, supported by government efforts to increase the share of the cleaner-fuel in the national energy mix, as Beijing seeks to reduce carbon intensity and improve air quality in its urban centres, BMI Research has said.

Gas consumption also benefited from stronger-than-expected economic growth over the first half of the year, which led to greater uptake among industrial users.

A number of other key sectors, including glass, ceramics, textiles, appliances and building materials, also more aggressively switched to gas (from coal) in order to comply with government directives, the Fitch Group company said.

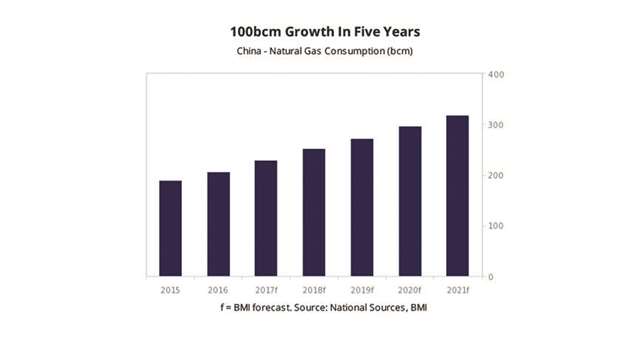

This has led BMI to revise up its gas consumption forecast for China to grow by 11% on year in 2017 (from 9% previously), from 206.9bcm in 2016 to 229.7bcm in 2017.

This brings its forecast closer to that of the National Energy Administration (NEA), which anticipates domestic gas demand to hit 230bcm this year. Thereafter, BMI expects consumption to average annual growth of 10%, reaching 297.5bcm by 2020.

This is comparatively more conservative to Beijing ‘s consumption target of 350bcm by 2020, which BMI believes to be overly ambitious.

Nonetheless, growth will be powerful and by 2021, BMI forecasts Chinese consumption to have increased by 111bcm from 2016 levels.

Firm policy backing from Beijing will be crucial to ensuring that China’s gas consumption continues to grow robustly over the coming years.

For instance, a recent set of guidelines published by the National Development and Reform Commission (NDRC) calls on local governments to encourage greater fuel switching among industrial, residential end-users by providing subsidies, and offer financial incentives to advance gas-related projects, including power plants, storage facilities and pipelines.

Robust growth in consumption will be matched by comparable growth in production. China’s gas production grew 12.8% y-o-y over the March-July period and BMI forecasts growth to average 4%-5% per annum through to 2020.

The bulk of the growth will come from offshore and unconventional sources, with state-owned giants Sinopec and CNPC spearheading developments of the latter.

Beijing is also gradually opening up the previously state-dominated shale gas exploration space to private, foreign investors.

In August, it held the first shale gas exploration rights auction for blocks in the Guizhou province.

Despite g rowing production, China will continue to require imports to meet about 45% of domestic demand.

Appetite for LNG will remain especially strong in the short-term. China imported 15.9mn tonnes of LNG over H1, 2017, compared to 15.2mn tonnes for pipeline gas, and stronger preference for LNG will remain in play over the coming quarters as China’s state-owned importers ramp up purchases from Australia and the United States.

Ongoing liberalisation of the domestic LNG market will also help LNG imports, by allowing smaller, private players to participate in the spot market.

Appetite for spot cargoes should also be plentiful as ample supplies, competitive prices and flexibility of LNG contracts appeal to buyers seeking greater supply and pricing diversity.

“We forecast such robust growth in LNG demand to lead China to become the second largest buyer of LNG in Asia by 2018, overtaking South Korea. Pipeline gas imports will continue to trump LNG in volume terms, and long-term growth will be supported by new pipeline connections to Central Asia and Russia,” BMI said.