Futures are trading near a nine-month high as President Donald Trump’s reaction to a white-supremacist rally sparked outrage among business leaders and citizens and engulfed his administration in tumult. Traders rushed to the haven amid concern political uncertainty will derail US economic growth, while a terror attack in Barcelona also increased demand.

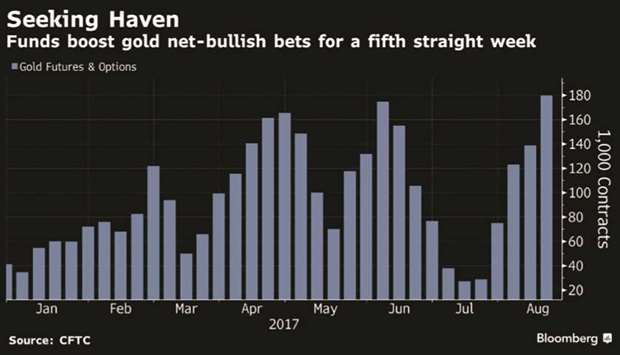

Money managers pushed their net-bullish bets on the metal to the highest since October, and investments through exchange-traded funds also jumped.

“Investors are looking for insurance,” said Chad Morganlander, a Florham Park, New Jersey-based money manager at Stifel, Nicolaus & Co, which oversees $240bn. “We’re in unchartered waters when it comes to political hostility, domestic and foreign.”

Prices have pushed higher since early July as tensions between the US and North Korea also escalated. Earlier this month, billionaire Ray Dalio, who manages Bridgewater Associates, recommended investors allocate between 5 to 10% of their assets to gold as a hedge against political and economic risk. They’ve heeded the advice, pushing assets in bullion ETFs to $85.9bn, near the highest in more than two months.

Hedge funds and other large speculators increased their gold net-long position, or the difference between bets on a price increase and wagers on a decline, by 30% to 179,537 futures and options contracts in the week ended August 15, according to US Commodity Futures Trading Commission data released three days later. The wagers surged more than six-fold over five straight weeks of gains.

Gold futures have climbed 12% this year, reaching $1,306.90 an ounce on Friday on the Comex in New York. That’s the highest since November 9. Traders and analysts are optimistic the rally has room to run, with almost half of those surveyed by Bloomberg expressing bullish sentiment. Futures traded at $1,293.10 yesterday.

Dalio made his recommendation in a LinkedIn post earlier this month. He cited the tensions between Trump and North Korea’s Kim Jong-un and the odds that the US Congress will fail to raise the debt ceiling, that could lead to a “technical default, a temporary government shutdown, and increased loss of faith in the effectiveness of our political system.” Bridgewater Associates, the world’s largest hedge fund, added SPDR Gold Shares to its portfolio in the second quarter, a government filing showed August 10.

About $1.1tn was wiped off the value of global equities last week amid the US chaos, bolstering the appeal of gold.

The political and economic uncertainties are spurring a return of investors who were exiting gold ETFs earlier this year. Last week through Thursday, more than $350mn poured into SPDR Gold Shares, the largest such fund.

It was a tumultuous week at the White House that sparked blistering comments from Republican lawmakers on Trump’s reactions to the violent white-supremacist rally in Charlottesville, Virginia. The fallout prompted the dissolution of two advisory groups of American business leaders after several chief executive officers quit. On Friday, Stephen Bannon, who served as a link to the “alt-right” movement – which features a mix of racism, white nationalism and populism – was ousted as Trump’s chief strategist. As news of Bannon’s departure erased gold’s gains that day, investors dumped holdings of bullish call options.

Gold has struggled to stay above $1,300 throughout the year, leaving little incentive for investors to accumulate the metal at current prices, said John LaForge, the Sarasota, Florida-based head of real assets strategy at Wells Fargo Investment Institute, which oversees $1.8tn. Prices in the 12 months through Friday were down almost 5%.