Dollar weakness propelled emerging stocks to near three-year highs yesterday and some currencies hit multi-month peaks, boosted also by signs of healthy economic growth and a rise in Chinese corporate profits.

European emerging currencies gained less, the rouble especially, an outlier due to fresh US sanctions on Russia.

Overall, emerging assets received a shot in the arm as US Federal Reserve comments on inflation were interpreted as suggesting that a recent growth slowdown may not be temporary, reducing the pressure for interest rate hikes.

The dollar touched 13-month lows against a currency basket.

“This slight change of emphasis regarding how inflation is behaving has delivered a boost to risk appetite, supporting emerging market stocks and currencies as it has drawn down the value of the dollar index,” said Inan Demir, senior emerging economist at Nomura.

“The China data will have helped sustain that sentiment,” he said, referring to a 19% jump in industrial firms’ June profits.

MSCI’s emerging equity index rose 1% to the highest since September 2014, while an index for Asian shares outside Japan approached decade-highs.

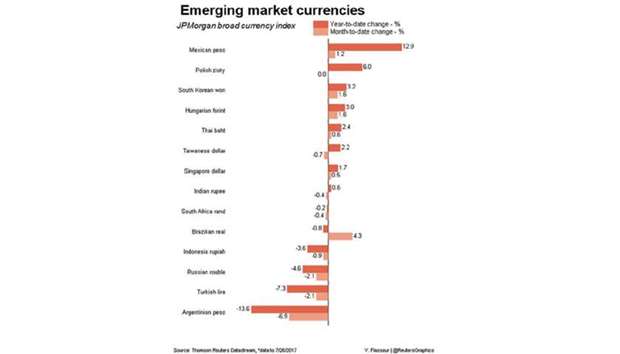

Many Asian currencies surged to multi-month highs against the dollar, with the Chinese yuan posting its best session in almost two months and the Thai baht at two-year peaks on a strong economic growth forecast.

In emerging Europe the mood was dampened by the euro’s continued rise while the rouble was pressured by US plans for sweeping new sanctions targeting Russian energy, debt, transport and other sectors.

The currency was flat after a 0.7% gain on Wednesday against the dollar but is on track for a second week of losses while bond yields are the highest in three weeks on expectations that rate cuts will proceed less slowly.

The Turkish lira firmed 0.2% against the dollar after closing 1% higher in the wake of the Fed meeting and the central bank is expected to stick to a hawkish tone at its meeting later in the day.

Demir noted risks to the lira from the euro surge.

“The lira recovery has mostly been a dollar weakness phenomenon, and euro/lira is close to all-time highs still.

So the underlying depreciation pressures for the currency are still there – that’s another argument for the central bank to keep short-term rates high via tight liquidity management,” he said.

The rand was likewise flat near one-month highs hit on Wednesday as markets awaited producer inflation data that is expected to show slowing factory prices.

The zloty weakened 0.3% against the euro and stocks fell 0.6%, with investors watching for repercussions from a European Commission decision to start legal action against Poland over a controversial judicial overhaul.

Commerzbank advised clients to keep a close eye on Polish political developments, adding: “We see further upside for EUR-PLN in coming weeks.”