Do we need cash? Humans have used all sorts of things to exchange items of economic value – rare metals, strings of shells and even sunken boulders. Those objects have gotten more ephemeral, with paper money replacing most coins, and digital forms increasingly supplanting paper. Could physical cash go away entirely? Economists see great payoffs in a cashless society: lower transaction costs, new tools to manage economic growth and an end to tax evasion and money laundering. Critics see an end to privacy, frightening new powers for tyrants and costs that would fall disproportionately on the poor. The giant, if unintended, experiment that followed India’s attempt to withdraw 86% of cash in circulation showed one thing clearly: The end of cash is not likely to be a neat or simple process.

How much of money is cash?

Not that much, at least in terms of economic activity. According to the Switzerland-based Bank for International Settlements, there was a combined $4.54tn worth of cash circulating in the countries of the eurozone and 17 other major economies at the end of 2015. That accounted for only 8.9% of their combined gross domestic product, a figure that crept up about 70 basis points since 2011 because of more per-capita cash in the US and eurozone. The US had the most notes being used, at $1.42tn, but Japan had the highest banknotes-to-GDP ratio, at 19.4%. Of course, each dollar, yen, euro or kronor changes hands several times a year, creating a multiplier effect on the amount of money.

What would it mean to go cashless?

With a swipe of a card, a click of a mobile-phone app or an impress of your forefinger, you’d have instant access to your entire wealth. Invisible networks connecting banks, shops, governments and businesses would handle the flow of transactions, changing the face of banking forever. A glimpse of this future is already evident in India, where 255mn people use Paytm, a seven-year-old startup backed by China’s Alibaba Group Holding Ltd, to make payments through a virtual wallet.

Who’s gone the furthest?

In the homeland of ABBA, the band whose “Money, Money, Money” made waves in the 1970s, cash is vanishing. Sweden is the most cashless society on the planet, with banknotes and coins accounting for just 1.7% of its GDP. Even churches are going digital, accepting donations via mobile phones. Nigeria has signed up with MasterCard to deploy a new national-identity card with a prepaid payment system.

Who’s in favour of going cashless?

A wide range of institutions, including:

Governments: With every financial transaction recorded, they can tax us better, choke the financing routes of bad guys and make transactions like drug trafficking easier to track. Direct transfers to beneficiaries of official programmes can be more efficient by cutting out middlemen.

n Central banks: Records that don’t miss any financial activities are more useful in devising appropriate monetary policies.

n Businesses: The costs and risks of storing cash will be eliminated and payment bottlenecks in the supply chain will be history.

n Technology providers: Imagine the power that comes from running the economic backbone of a society.

n Credit-card companies: They’re already pushing merchants to ditch paper currency.

n Numismatists: Their coin collections would be that much rarer.

How would cash-free

economies be easier to

manage?

Some digital-society proponents say economies will be healthier without paper money. After the financial crisis of 2008, many central banks cut interest rates to near zero to stimulate the economy, with limited success. The European Central Bank and the Bank of Japan pushed rates slightly below zero to nudge banks into lending rather than sitting on their reserves. More deeply negative rates, which some economic models say are needed, are hard to impose if people and businesses can hoard cash. In a cashless society, a central bank could force spending by in effect imposing a tax on savings. The theory is not validated yet. And a tax on savings could face enormous opposition.

What are the risks?

All sorts of things. In a digital-only economy, governments and banks could take control of your financial life; with a flick of a switch, they could leave you without a penny. Networks can fail. You could lose your mobile phone. And everybody could be vulnerable to a cyber attack or power outage, which is why the US government encourages citizens to keep some cash on hand for emergencies.

How would the switch affect the poor?

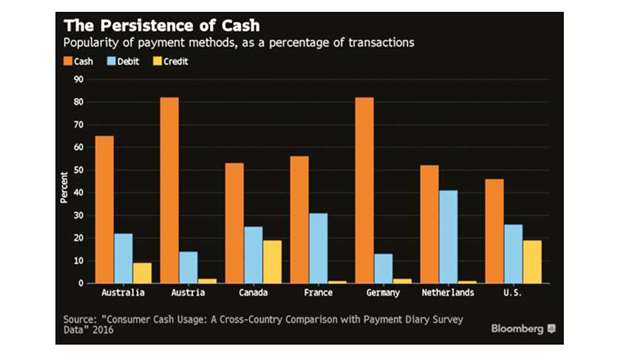

Billions of poor people in the developing world depend on cash to buy goods for very small amounts, often mere cents. It may be too costly to host those transactions on a network. That could create a second-class citizenry of people who don’t have equal access to banking services. In India, millions of new savings accounts opened under a financial-inclusion plan remain inactive, because banks find ways to cap free transactions and charge the poor for the services. Even in the US, cash is used for more than 60% of purchases under $10, according to the Federal Reserve. On the other hand, services like Paytm in India and mobile-phone networks such as Kenya’s M-Pesa show how the poor can benefit. People in remote villages, who have never entered a bank branch in their lives, are embracing the digital economy, going beyond day-to-day transactions to try out newer services like micro-business loans.

How else might digital-only money change things?

It might make us dumber, or at least less thrifty. Behavioural economists have shown that spending cash imposes a psychological “pain” on the consumer that helps them to be prudent. Credit and debit cards took us one step away from that pain. Economists and some data suggest that an even more frictionless digital economy could make us even more reckless. Good for some retailers, maybe, but not helpful for bank accounts.

What’s happened in India?

On November 8, 2016, India announced that it would withdraw all 500-rupee ($7.70) and 1,000-rupee notes, representing 86% of currency in circulation, to counter tax dodgers and counterfeiters. Citizens had less than two months to exchange their bills for new ones. But with a paucity of currency notes, most were forced to deposit their money in bank accounts. That choked the informal economy in a country where 93% of workers are hired without any paperwork. Even companies struggled to pay salaries and contractors couldn’t get work. Millions of poor people couldn’t buy food or pay for medical care. Within six days of the cash ban, at least 25 people died, either collapsing in the lengthy queues in front of banks or having been turned away by hospitals. Economic growth slowed to a two-year low.

How did that end?

The government retreated. By the end of June 2017, the Reserve Bank of India had restored 87% of the currency supply, and newspapers reported the central bank planned to introduce new denominations. Whether the touted benefits materialised remains a question. New deposits in banks failed to live up to initial projections, while everyday corruption in government offices continues.

What does that mean for the cashless idea?

India now aims to be a “less cash” society rather than a “cashless” one, according to Finance Minister Arun Jaitley. The so-called demonetisation exercise drew lots of criticism, including from Steve Forbes, the editor-in-chief of Forbes magazine, who called the cash ban “massive theft of people’s property” and “breathtaking in its immorality.” The cashless idea, however, isn’t going to go away. In Australia, Citibank stopped accepting cash at its branches after most of its customers embraced digital transactions. The European Central Bank is considering withdrawing t

he €500 note to counter terrorist financing.

Plastic-versus-cash battle heats up after Visa, Mastercard deals

GOING