China’s manufacturing sector expanded at the fastest pace in three months while South Korea’s grew for the first time in 11 months.

In emerging Europe, Turkish manufacturing activity expanded at its quickest in more than three-and-a-half years, whilst Poland and Russia also continued to accelerate.

oil prices also rose, inching up to a two-week high.

“Data flow from the PMIs have been quite solid,” Manik Narain, emerging FX strategist at UBS, said, referring to Purchasing Managers Indexes. “Between the commodities and the tech cycle, emerging market equities have held up quite well.”

MSCI’s benchmark emerging stocks index rose 0.2%, with Polish and Turkish stocks up 0.3%, while Russian stocks rose 0.8%, helped by higher oil prices.

Chinese mainland shares delivered a mixed performance but Hong Kong was supported by financials, the biggest beneficiary of a new Bond Connect scheme that links China’s $9 trillion bond market with overseas investors.

Indian stocks rose almost 1% after tobacco manufacturer ITC jumped nearly 10% to a record high.

Taxation for cigarettes under a new goods and services levy is around 5-6% lower than under the previous structure.

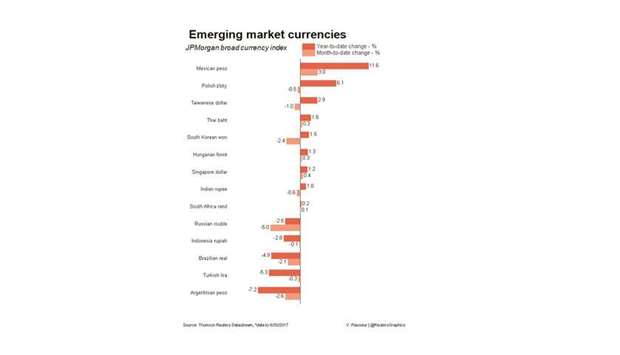

With the dollar firming 0.3% against a basket of currencies and US 10-year yields at six-week highs, emerging currencies struggled to make headway, with the South Korean won weakening 0.2% and the Indian rupee down 0.3%.

South Africa’s rand slipped 0.4%, extending losses to a third straight session. A no-confidence vote in President Jacob Zuma has been delayed to August 8.

Finance Minister Malusi Gigaba said he would present an action plan on Friday to boost economic growth, drawing on issues raised by investors and ratings agencies.

The lira fell 0.2% after Turkish consumer inflation dipped in June.

“The sharper-than-expected fall in Turkish inflation last month to 10.9% year-on-year raises the risk that the central bank will begin to reverse its recent tightening cycle sooner than we had previously anticipated,” analysts at Capital Economics said in a note.The Czech crown firmed to its strongest against the euro since the central bank abandoned its weak crown policy in early April. Czech employment growth accelerated to its strongest since March.